From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

We Need Single Payer Healthcare For All NOW!

Date:

Saturday, January 31, 2026

Time:

12:00 PM

-

1:30 PM

Event Type:

Class/Workshop

Organizer/Author:

National Campaign For Single Pay

Location Details:

Harry Bridges Plaza

Next to Ferry Building

Next to Ferry Building

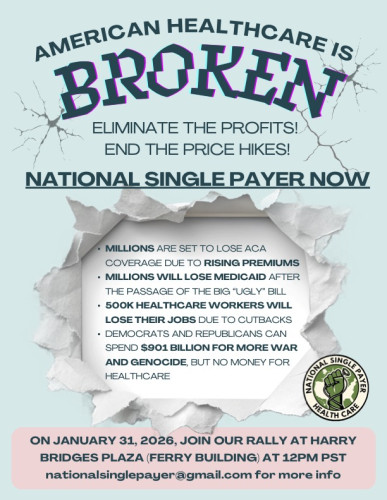

American Healthcare is Broken: National Single Payer Rally

Saturday, January 31·12:00 – 2:00pm

Harry Bridges Plaza, San Francisco, CA, USA

AMERICAN HEALTH CARE IS SICK

ELIMINATE THE PROFITS END THE PRICE HIKES!

PUT NATIONAL SINGLE PAYER ON THE TABLE

End the national disgrace that gives hundreds of billions in tax payer subsidies to ACA insurers who made $71.3 Billion in profits in 2024. Meanwhile, 40% of working age Americans are without any coverage or have junk health insurance.

Millions are set to lose ACA coverage and tens of millions will be saddled with rising employer health insurance premiums. Millions will lose Medicaid due to the “Big Ugly Bill.” This will kill tens of thousands of Americans and add more medical bankruptcies created by our private run healthcare system.

None of the “fixes” by the bought-and-paid politicians will end the crisis of affordability or provide the healthcare Americans need because Washington’s first priority is to maintain the profits of the insurers.

We need to urge our unions, particularly healthcare unions to join in these rallies. 500,000 healthcare workers will be terminated with these cutbacks and our unions need to mobilize their members and those who need healthcare together in this fight.

While both the Democrats and Republicans can pass a $901 billion military spending bill for more war and genocide, they have no money for healthcare for all.

INSURERS PROVIDE NOTHING OF VALUE TO HEALTHCARE

ON JANUARY 31, JOIN A RALLY CLOSE TO YOU!

STAND UP AND DEMAND IMPROVED AND EXPANDED MEDICARE FOR ALL

END FOR PROFIT HEALTHCARE NOW!

We Need Healthcare NOW With Single Payer

https://nationalsinglepayer.com

Healthcare cuts will strip 2.5 million Medi-Cal enrollees and up to 2.6 million Covered California participants of health care coverage, and eliminate 217,000 California health care jobs. https://www.sfchronicle.com/politics/article/billionaire-tax-ballot-california-21284717.php. A major driver of the proposal is the One Big Beautiful Bill Act passed by the Republican-led Congress and signed by President Donald Trump last year. That measure could bleed California hospitals of $128 billion over the next decade, the California Hospital Association estimated. The California Medical Association predicts it will strip 2.5 million Medi-Cal enrollees and up to 2.6 million Covered California participants of health care coverage, and eliminate 217,000 California health care jobs.

Corrupt Newsom Backtracked On Single Payer

Where Will Gov. Newsom’s Evolution on Health Care Leave Californians?

https://capitalandmain.com/where-will-gov-newsoms-evolution-on-health-care-leave-californians

As he heads into his final year in Sacramento — and mulls a presidential campaign — some in the Golden State have gained access to more care, others not so much.

GettyImages-2242675734-scaled.jpegGov. Gavin Newsom speaks to reporters at the California Economic Summit in Stockton in October. Photo: Justin Sullivan/Getty Images.

Published on December 24, 2025By Mark Kreidler

California’s health care landscape today would probably disappoint the Gavin Newsom who spent much of 2017 and 2018 on the road, campaigning to become governor.

Before taking over as California’s top executive, Newsom, who had previously done a high-profile stint as San Francisco’s mayor, loudly espoused a single-payer system of care under which the state would be the sole supplier of health coverage and everybody would be included.

“There’s no reason to wait around on universal health care and single-payer in California,” Newsom said on the campaign trail. “You have my firm and absolute commitment as your next governor that I will lead the effort to get it done.”

But as former New York Gov. Mario Cuomo once observed, politicians generally campaign in poetry and govern in prose. Upon taking office in 2019, Newsom, faced with massive budget issues and political pushback, quickly began retreating from the single-payer-system idea. In so doing, he angered groups like the California Nurses Association, which had campaigned aggressively for him because of his devotion to that specific concept. (Disclosure: The CNA is a financial supporter of Capital & Main.)

Instead, the governor pivoted to “universal access” to care — the notion that, through one program or another, everyone in the state would be able to see a doctor.

Newsom pitched it as a bridge to a better health care system down the line. Now, as he prepares for the final year of his second term and eyes a potential presidential run in 2028, that slimmed-down vision for California remains unrealized.

The state’s severe budget deficit this year forced Newsom to back off expansion of Medi-Cal to low-income adults who don’t have legal residency, and the looming expiration of federal subsidies due to cuts through the Affordable Care Act will push hundreds of thousands of Californians off the plans they’ve bought through Covered California.

The governor has carved out some notable gains through the years, including a cap on out-of-pocket costs on insulin and multiple expansions of Medi-Cal coverage for various age groups, regardless of their immigration status. As Newsom begins his final year in Sacramento before he is termed out of that office, the landscape is shifting again.

Here are a few of the major changes in California’s health care policies and coverage for 2026:

Enrollment freeze for undocumented adults. Beginning Jan. 1, low-income adults ages 19 and older who are undocumented are no longer eligible to sign up for Medi-Cal. Those who are already enrolled may stay in the program as long as they renew their coverage.

Under Newsom, the Legislature folded almost all undocumented residents into Medi-Cal, California’s version of Medicaid, which covers about a third of all people in the state. In the absence of a plan for a single-payer system, Newsom had touted this expansion as a way to get the state closer to health care access for everyone.

Between that move and a surge of sign-ups during the pandemic — when income eligibility requirements were temporarily suspended — Medi-Cal experienced rapid enrollment growth, rising from about 13 million to nearly 15 million today. As a result, the price tag for administering the health coverage plan soared.

Medi-Cal had to borrow $3.4 billion from the state’s general fund this year to meet escalating costs. Earlier this year, the state estimated that about 1.6 million undocumented immigrants were enrolled in the program.

With the state facing an estimated $12 billion budget deficit, Newsom and Democratic lawmakers scaled back the commitment to undocumented adults. Newsom’s administration has estimated that the enrollment freeze, along with a monthly Medi-Cal premium for immigrants beginning in 2027 and a reduction in dental coverage this year (see below), could save the state more than $5 billion.

Reinstatement of the Medi-Cal asset test. Beginning Jan. 1, adults can be denied access to Medi-Cal if they’re deemed to hold too much in assets, like bank account totals, cash on hand, second cars or second homes.

The asset limit is $130,000 for an individual and $195,000 for a couple. It applies to those who are over 65, have a disability, live in a nursing home or are part of a family that otherwise makes too much to qualify for Medi-Cal.

California had eliminated the asset test in 2024, overjoying advocacy groups who’ve long contended that it stymies adults who are just trying to save modest amounts to achieve some financial security.

Now the state is bringing the test back, albeit in a less restrictive way. The Legislature declined to go with Newsom’s original proposal to set the asset limits at $2,000 per person and $3,000 for a couple, instead putting the much higher numbers in place.

Elimination of some dental coverage. On July 1, the state will end so-called full scope dental coverage for undocumented immigrants age 19 and over. Only emergency dental care will be covered. Children and pregnant people will continue to receive full dental coverage regardless of their immigration status.

The state has been down this road before. In 2009, California eliminated nonemergency dental coverage for most adult Medi-Cal patients in a budget-cutting move before slowly reinstating much of it over the next five years. The 2026 policy applies to undocumented adults only, not the rest of the Medi-Cal population. State estimates project $300 million in savings for the 2026-27 fiscal year.

Lower insulin costs. Newsom signed into law a new $35 cap on the cost of a month’s worth of insulin beginning Jan. 1 for people with private health coverage through large insurers like Kaiser, Anthem, Blue Shield and Health Net. Smaller group insurers, such as small businesses who buy coverage through Covered California, will be subject to the cost cap beginning in 2027.

The governor also announced that, starting Jan. 1, insulin pens will be available to California consumers at $55 for a five-pack through the state’s own CalRx program. (The pens are also available to pharmacies for $45 per five-pack.) State-compiled data released during the governor’s October announcement pegged the cost for a five-pack made by major pharmaceutical companies at between $90 and more than $400, indicating substantial savings under the state-led production partnership with a nonprofit generic drugmaker, Civica Rx.

“California and Civica are showing the nation what it looks like to put people over profits,” Newsom said in a statement accompanying the announcement. “No Californian should ever have to ration insulin or go into debt to stay alive — and I won’t stop until health care costs are crushed for everyone.”

With 12 months before he moves on, that goal of Newsom’s won’t be reached. Instead, he’ll spend that time making small steps to regain some of the ground that’s been lost over the tumultuous past year — the pure reality of governing.

SF health workers say they fear hospital stabbing ‘can happen … to any of us’

https://www.sfexaminer.com/news/public-health/alberto-rangel-stabbing-sfgh-hospital-safety/article_4d983a55-690a-4d5f-9786-e01cfeb9418d.html

By Natalia Gurevich | Examiner staff writer 18 hrs ago

The exterior of Zuckerberg San Francisco General Hospital and Trauma Center is seen in San Francisco, Monday, Dec. 14, 2020.

Jeff Chiu/Associated Press

San Francisco health-care workers are calling loudly for stronger safety procedures at The City’s medical facilities following the killing of a social worker at Zuckerberg San Francisco General Hospital last week.

Members of UCSF’s University Professional and Technical Employees chapter said at a press conference Wednesday that they have requested a joint meeting with hospital leadership Thursday and a written response to their safety demands following the fatal stabbing of Alberto Rangel. The union will also hold a safety rally Thursday outside the hospital’s Potrero Street entrance.

Rangel, 51, died of his injuries Saturday after he was stabbed multiple times Dec. 4, according to police and prosecutors. The San Francisco Department of Public Health has said it will hire “an independent, outside security firm” to review safety and security at the hospital, “DPH clinics and other environments,” in the wake of the killing.

Rangel’s death is part of “a growing national crisis,” said UPTE-CWA 9119 Executive Vice President Matias Campos, making the UCSF social worker’s killing a shock but not a surprise.

“We know a lot of our members historically have expressed their concerns around safety at the workplace,” said Campos, whose union represents 22,000 health-care, research and education workers across the University of California system and counted Rangel as a member.

“This is not something new that our union has been calling for or demanding for,” he said. “We have been doing that for years — advocating for stronger safety measures, adequate safe staffing and case ratios, and protections for social workers.”

The San Francisco District Attorney’s Office charged Wilfredo Jose Tortolero Arriechi, 34, with murder and an enhancement that he personally used a knife in the commission of the crime. He was set to be arraigned Tuesday but will now be arraigned Dec. 16, according to court records. Multiple outlets reported Tuesday that his arraignment was delayed because he is being held in the psychiatric unit at San Francisco General Hospital.

Prosecutors allege that Tortolero Arriechi concealed a knife when he went to the hospital’s Ward 86 — its internationally renowned HIV/AIDS clinic run in conjunction with UCSF — to speak with a doctor. A social worker told him to leave, prosecutors said, and Rangel then accompanied Tortolero Arriechi to the elevator. Tortolero Arriechi then “grabbed the victim from behind and stabbed him numerous times,” prosecutors said Monday in a press release announcing the charges.

Campos and his fellow speakers Wednesday said Rangel’s death was the latest in a concerning trend.

The union leader pointed to a 2020 Bureau of Labor Statistics report that showed health-care and social-services workers were five times more likely to be the victims of workplace violence, and that health-care workers accounted for 73% of all nonfatal workplace injuries and illnesses from violence in 2018.

Almost 82% of the nearly 1,000 respondents in a 2024 National Nurses United report said they’d experienced some kind of violence at work in 2023, while nearly 46% said it increased from 2022.

Julette Suarez, a licensed clinical social worker at the hospital’s trauma-recovery center, said UPTE-CWA 9119’s safety demands included physical changes such as the installation of panic buttons, cameras, and metal detectors or similar screenings at patient entrances.

Enhance the Subsidies and Let the Insurance Industry Feed at the Federal Trough?

https://www.counterpunch.org/2025/11/10/enhance-the-subsidies-and-let-the-insurance-industry-feed-at-the-federal-trough/

ANA MALINOW

NOVEMBER 10, 2025

It’s helpful to think of the U.S. health care system like a pie made up of different slices (Figure). The largest (blue) slice is employer health insurance, which covers 160 million workers and their dependents; individual non-group insurance (in orange) provides 24 million individuals and their families with patchy insurance (including the enhanced subsidies); Medicaid (in yellow) covers 65 million poor and low-income adults, children, and seniors; Medicare (in red) pays for medical care for 60 million seniors and people with disabilities; the Veteran’s Health Administration (in bright green) provides the best socialized medicine in the nation to 9.1 million qualifying veterans; and that leaves the rest, approximately 28 million Americans, in the (purple) slice of the uninsured. It’s a patchwork arrangement that keeps Americans sliding from one slice to another their entire life until they turn 65, when they finally land on Medicare.

Figure: The U.S. patchwork health care arrangement

A colorful pie chart with textAI-generated content may be incorrect..jpeg

Source: Health Insurance Coverage of the Total Population | KFF; Veterans Health Administration; and ReportsSummary.pdf.

One thing about a pie chart, it’s simple geometry. If you make one slice bigger, by definition, you make another slice smaller.

Simple geometry was what President Obama had in mind, when he signed the Patient Protection and Affordable Care Act (ACA) into law in 2010. Despite the name, President Obama and Senator Max Baucus, then chair of the powerful Senate Finance Committee tasked with developing the legislation, gave up on making health care affordable (which would have required the elimination of health insurance companies) and instead concentrated on increasing the number of individuals with health insurance. It attempted, quite successfully, to shrink the slice of the uninsured.

To do this, the ACA included an employer mandate, expanding the slice of individuals covered by their employer, an individual mandate, increasing the slice of the non-group market, the expansion of Medicaid, which enlarged the slice of individuals who qualified, kept the Medicare and VA slices the same size, and presto! The slice of the uninsured shrank. As if by a miracle, the number of uninsured dropped from 50 million to 25 million almost (OK, it took four years to get through the courts) overnight. It was nothing more than simple geometry.

The non-group market

To understand the government shutdown, it’s important to delve deeper into the non-group, private health insurance (orange) slice of the health care pie, where 24 million individuals now get their health insurance.

The slice didn’t start out that large. Before the ACA, only 8 million individuals purchased private health insurance on their own. Unlike individuals who receive their private health insurance from their employer, who typically pays a significant chunk of the monthly premiums, leaving the employee to cover a smaller share of the premium, individuals in the non-group market paid the entire share of the monthly premiums on their own. In 2010, before the passage of the ACA, the average annual cost for health insurance for a family in the individual, non-group market according to America’s Health Insurance Plans, was almost $12,000 for premiums plus their deductible.

For the average worker, making a little over $49,000 in 2010, paying for health insurance meant spending 25% of their income on health insurance premiums (not including the yearly deductible). Expensive health insurance was then, and remains today, the major driver of uninsurance.

Enter the ACA and the individual mandate, which required everyone to have health insurance (either public or private) or be faced with a hefty fine.

The architects of the ACA recognized that the government could not possibly mandate the average worker to spend 25% of their income on health insurance, or worse yet, a worker making minimum wage (those least likely to be covered by their employer), making $15,000 annually in 2010, to spend practically their entire income on health insurance.

To get around this inconvenient reality, low-income individuals outside of the group market would now be able to purchase their private health insurance through a “Marketplace” where the government would (like the employer in the group market) pay a share of the monthly premium. The government share, based on the individual’s income, became known as the “subsidy” or a premium tax credit, a complicated system of advanced premium tax credits (APTCs) based on estimated income which must be accounted for when individuals file their federal income taxes. If the APTC was less than the estimated income, the difference is received as a tax credit used to lower the amount of taxes owed. If the advanced payments were greater than the final income received that year, some or all of the excess would need to be repaid.

The lower low-income workers would receive a larger subsidy from the government, while higher low-income workers (up to 400% of the federal poverty level), would receive a smaller federal subsidy to cover their health insurance premiums. Individuals and their families could choose coverage from “metal tiers” that went from crappy (Bronze, low premiums, high deductible) to good (Platinum, high premiums and lowish deductible).

While the government paid the subsidy to make the premiums cost no more than 8% of the worker’s paycheck, the government did a little something about the deductible, which could be thousands of dollars every year, and had to be met before the insurance company would start paying claims.

The “little something” could lower the cost of variable costs when using health insurance (the whole point of having health insurance) such as a deductible. It applied only to individuals and their families with annual incomes between 100-250% of the federal poverty level and only for a Silver plan. This created a high-stakes decision for very low-income families. Do they go for the Bronze plan with low monthly premiums but very high deductible, gambling they will not need health care that year, or go for the Silver plan with the higher monthly premiums but reduced deductible?

The size of the slice grew from 8 million to 11 million individuals and their families.

When President Trump came into office the first time, he and Congress eliminated the individual mandate, but did nothing to make health care more affordable. Now it was legal to be uninsured again.

While people struggled to pay their medical bills, one sector of the economy that was not struggling was the insurance industry, which was collecting the subsidies every year from Uncle Sam, plus the premiums that individuals and their families paid every month, plus the yearly deductibles. Health insurance companies collected billions before they ever had to pay out one penny for medical claims.

Then came the pandemic.

COVID and the enhanced subsidies

In March 2021, the Democrats pushed through a two-year expansion of the Affordable Care Act in the COVID-19 relief bill. The bill enhanced the Marketplace subsidies, meaning the federal government would now pick up a greater share of the monthly premium. Suddenly, people found themselves paying $0 monthly premiums. Even workers who had traditionally been closed out of the Marketplace because they “made too much money” (i.e., above 400 percent of the federal poverty level, which in 2021, for a couple, was a little over $69,000 per year) now qualified for cheap health insurance plans with “enhanced subsidies.”

There were just three caveats.

One: Annual deductibles continued to be extraordinarily high, as high as $14,700 for a family of four whose income was at 250% of the federal poverty level. So yes, while people had “health insurance” on paper, it left people in medical debt if they sought medical care or the option to avoid care altogether, even as they and the federal government continued to pay the premiums.

Two: The legislation directed some $20 billion more to health insurance companies by making enhanced premium subsidies for more consumers who now qualified for plans.

Three: The enhanced subsidies would expire December 2025.

Even if substandard, these plans did mean a lifeline to millions of Americans who lost their jobs during the pandemic and found themselves without health insurance. The enhanced subsidies expanded the non-group market to 24 million Americans and kept the uninsured slice from ballooning out of control (as did continuous enrollment in Medicaid, but that’s another story).

Unfortunately, instead of using a once-in-a-lifetime pandemic to ensure health care as a human right to everyone and expand Medicare to all, Congress worked double duty to expand Medicaid, enhance the subsidies and keep the private health insurance industry feeding at the federal trough.

While the government was paying larger shares of health insurance premiums for more people, health insurance premiums continued to rise without pause. The federal government could have mandated price controls on the subsidies they were paying, but of course, nothing of the sort happened. From 2014 (when the Marketplace was launched) to 2025, health insurance premiums increased 60%, with the federal government subsidizing the growth. Today, gross margins per enrollee in the Marketplace are 15% higher than in the group, employer market.

Little wonder that the Congressional Budget Office recently predicted that expanding the enhanced subsidies in the Marketplace will cost $350 billion over the next 10 years.

If enhanced subsidies expire, Marketplace enrollees (making 100-400% of the federal poverty level) will continue to qualify for a pre-pandemic subsidy, while others will lose eligibility altogether. Because health insurance has been rising (costs that individuals in the Marketplace might not have been aware of), and because insurers in the Marketplace are proposing to raise their rates by a median of 18% next year, millions will be hit with a “double whammy” of losing subsidies and being on the hook for rising premiums.

The government shutdown

Democrats, saying they are fighting to protect health care for Americans, refuse to pass a budget bill that does not expand enhanced subsidies permanently. They are joined by a bevy of predictable allies, including the American Health Insurance Association, the Federation of American Hospitals, and AARP, which sells Medicare Advantage plans.

Republicans, seeking a bill to temporarily extend federal spending at current levels without any add-ons (after slashing $1 trillion from the social safety net to pay for billionaire tax cuts), say the Democrats want to spend billions of federal dollars on undocumented immigrants, even though federal law prohibits Marketplace subsidies from being used by undocumented immigrants (see the amount of paperwork required above).

As a result of the intransigence in both parties, the federal government shut down in the early morning of October 1 after Congress failed to pass funding for federal programs and services.

Instead of shutting down the government and demanding real health reform, Democrats are quibbling over subsidies that keep Americans underinsured and in medical debt and importantly, continue pouring billions into the till of the health insurance industry.

Between a rock and a hard place

Should single payer activists support Democrats, and allow 24 million people to pay for some form of health insurance but enrich the very corporations we are fighting? Or do we turn our back on millions of Americans and deny a predatory, rapacious industry another penny?

The lesser of the two evils is to support a temporary extension of the enhanced subsidies and place strict price controls on what insurance companies can charge the government. If every crisis presents an opportunity, let’s use this one to pass a national, single payer health care system that guarantees health care to everyone and removes all profit from health care. Nothing short of this can heal this nation.

Dr. Ana Malinow is a retired pediatrician, who has dedicated her career to serving immigrant, refugee, and marginalized children. She has written extensively on U.S. health care policy. She co-leads National Single Payer.

Saturday, January 31·12:00 – 2:00pm

Harry Bridges Plaza, San Francisco, CA, USA

AMERICAN HEALTH CARE IS SICK

ELIMINATE THE PROFITS END THE PRICE HIKES!

PUT NATIONAL SINGLE PAYER ON THE TABLE

End the national disgrace that gives hundreds of billions in tax payer subsidies to ACA insurers who made $71.3 Billion in profits in 2024. Meanwhile, 40% of working age Americans are without any coverage or have junk health insurance.

Millions are set to lose ACA coverage and tens of millions will be saddled with rising employer health insurance premiums. Millions will lose Medicaid due to the “Big Ugly Bill.” This will kill tens of thousands of Americans and add more medical bankruptcies created by our private run healthcare system.

None of the “fixes” by the bought-and-paid politicians will end the crisis of affordability or provide the healthcare Americans need because Washington’s first priority is to maintain the profits of the insurers.

We need to urge our unions, particularly healthcare unions to join in these rallies. 500,000 healthcare workers will be terminated with these cutbacks and our unions need to mobilize their members and those who need healthcare together in this fight.

While both the Democrats and Republicans can pass a $901 billion military spending bill for more war and genocide, they have no money for healthcare for all.

INSURERS PROVIDE NOTHING OF VALUE TO HEALTHCARE

ON JANUARY 31, JOIN A RALLY CLOSE TO YOU!

STAND UP AND DEMAND IMPROVED AND EXPANDED MEDICARE FOR ALL

END FOR PROFIT HEALTHCARE NOW!

We Need Healthcare NOW With Single Payer

https://nationalsinglepayer.com

Healthcare cuts will strip 2.5 million Medi-Cal enrollees and up to 2.6 million Covered California participants of health care coverage, and eliminate 217,000 California health care jobs. https://www.sfchronicle.com/politics/article/billionaire-tax-ballot-california-21284717.php. A major driver of the proposal is the One Big Beautiful Bill Act passed by the Republican-led Congress and signed by President Donald Trump last year. That measure could bleed California hospitals of $128 billion over the next decade, the California Hospital Association estimated. The California Medical Association predicts it will strip 2.5 million Medi-Cal enrollees and up to 2.6 million Covered California participants of health care coverage, and eliminate 217,000 California health care jobs.

Corrupt Newsom Backtracked On Single Payer

Where Will Gov. Newsom’s Evolution on Health Care Leave Californians?

https://capitalandmain.com/where-will-gov-newsoms-evolution-on-health-care-leave-californians

As he heads into his final year in Sacramento — and mulls a presidential campaign — some in the Golden State have gained access to more care, others not so much.

GettyImages-2242675734-scaled.jpegGov. Gavin Newsom speaks to reporters at the California Economic Summit in Stockton in October. Photo: Justin Sullivan/Getty Images.

Published on December 24, 2025By Mark Kreidler

California’s health care landscape today would probably disappoint the Gavin Newsom who spent much of 2017 and 2018 on the road, campaigning to become governor.

Before taking over as California’s top executive, Newsom, who had previously done a high-profile stint as San Francisco’s mayor, loudly espoused a single-payer system of care under which the state would be the sole supplier of health coverage and everybody would be included.

“There’s no reason to wait around on universal health care and single-payer in California,” Newsom said on the campaign trail. “You have my firm and absolute commitment as your next governor that I will lead the effort to get it done.”

But as former New York Gov. Mario Cuomo once observed, politicians generally campaign in poetry and govern in prose. Upon taking office in 2019, Newsom, faced with massive budget issues and political pushback, quickly began retreating from the single-payer-system idea. In so doing, he angered groups like the California Nurses Association, which had campaigned aggressively for him because of his devotion to that specific concept. (Disclosure: The CNA is a financial supporter of Capital & Main.)

Instead, the governor pivoted to “universal access” to care — the notion that, through one program or another, everyone in the state would be able to see a doctor.

Newsom pitched it as a bridge to a better health care system down the line. Now, as he prepares for the final year of his second term and eyes a potential presidential run in 2028, that slimmed-down vision for California remains unrealized.

The state’s severe budget deficit this year forced Newsom to back off expansion of Medi-Cal to low-income adults who don’t have legal residency, and the looming expiration of federal subsidies due to cuts through the Affordable Care Act will push hundreds of thousands of Californians off the plans they’ve bought through Covered California.

The governor has carved out some notable gains through the years, including a cap on out-of-pocket costs on insulin and multiple expansions of Medi-Cal coverage for various age groups, regardless of their immigration status. As Newsom begins his final year in Sacramento before he is termed out of that office, the landscape is shifting again.

Here are a few of the major changes in California’s health care policies and coverage for 2026:

Enrollment freeze for undocumented adults. Beginning Jan. 1, low-income adults ages 19 and older who are undocumented are no longer eligible to sign up for Medi-Cal. Those who are already enrolled may stay in the program as long as they renew their coverage.

Under Newsom, the Legislature folded almost all undocumented residents into Medi-Cal, California’s version of Medicaid, which covers about a third of all people in the state. In the absence of a plan for a single-payer system, Newsom had touted this expansion as a way to get the state closer to health care access for everyone.

Between that move and a surge of sign-ups during the pandemic — when income eligibility requirements were temporarily suspended — Medi-Cal experienced rapid enrollment growth, rising from about 13 million to nearly 15 million today. As a result, the price tag for administering the health coverage plan soared.

Medi-Cal had to borrow $3.4 billion from the state’s general fund this year to meet escalating costs. Earlier this year, the state estimated that about 1.6 million undocumented immigrants were enrolled in the program.

With the state facing an estimated $12 billion budget deficit, Newsom and Democratic lawmakers scaled back the commitment to undocumented adults. Newsom’s administration has estimated that the enrollment freeze, along with a monthly Medi-Cal premium for immigrants beginning in 2027 and a reduction in dental coverage this year (see below), could save the state more than $5 billion.

Reinstatement of the Medi-Cal asset test. Beginning Jan. 1, adults can be denied access to Medi-Cal if they’re deemed to hold too much in assets, like bank account totals, cash on hand, second cars or second homes.

The asset limit is $130,000 for an individual and $195,000 for a couple. It applies to those who are over 65, have a disability, live in a nursing home or are part of a family that otherwise makes too much to qualify for Medi-Cal.

California had eliminated the asset test in 2024, overjoying advocacy groups who’ve long contended that it stymies adults who are just trying to save modest amounts to achieve some financial security.

Now the state is bringing the test back, albeit in a less restrictive way. The Legislature declined to go with Newsom’s original proposal to set the asset limits at $2,000 per person and $3,000 for a couple, instead putting the much higher numbers in place.

Elimination of some dental coverage. On July 1, the state will end so-called full scope dental coverage for undocumented immigrants age 19 and over. Only emergency dental care will be covered. Children and pregnant people will continue to receive full dental coverage regardless of their immigration status.

The state has been down this road before. In 2009, California eliminated nonemergency dental coverage for most adult Medi-Cal patients in a budget-cutting move before slowly reinstating much of it over the next five years. The 2026 policy applies to undocumented adults only, not the rest of the Medi-Cal population. State estimates project $300 million in savings for the 2026-27 fiscal year.

Lower insulin costs. Newsom signed into law a new $35 cap on the cost of a month’s worth of insulin beginning Jan. 1 for people with private health coverage through large insurers like Kaiser, Anthem, Blue Shield and Health Net. Smaller group insurers, such as small businesses who buy coverage through Covered California, will be subject to the cost cap beginning in 2027.

The governor also announced that, starting Jan. 1, insulin pens will be available to California consumers at $55 for a five-pack through the state’s own CalRx program. (The pens are also available to pharmacies for $45 per five-pack.) State-compiled data released during the governor’s October announcement pegged the cost for a five-pack made by major pharmaceutical companies at between $90 and more than $400, indicating substantial savings under the state-led production partnership with a nonprofit generic drugmaker, Civica Rx.

“California and Civica are showing the nation what it looks like to put people over profits,” Newsom said in a statement accompanying the announcement. “No Californian should ever have to ration insulin or go into debt to stay alive — and I won’t stop until health care costs are crushed for everyone.”

With 12 months before he moves on, that goal of Newsom’s won’t be reached. Instead, he’ll spend that time making small steps to regain some of the ground that’s been lost over the tumultuous past year — the pure reality of governing.

SF health workers say they fear hospital stabbing ‘can happen … to any of us’

https://www.sfexaminer.com/news/public-health/alberto-rangel-stabbing-sfgh-hospital-safety/article_4d983a55-690a-4d5f-9786-e01cfeb9418d.html

By Natalia Gurevich | Examiner staff writer 18 hrs ago

The exterior of Zuckerberg San Francisco General Hospital and Trauma Center is seen in San Francisco, Monday, Dec. 14, 2020.

Jeff Chiu/Associated Press

San Francisco health-care workers are calling loudly for stronger safety procedures at The City’s medical facilities following the killing of a social worker at Zuckerberg San Francisco General Hospital last week.

Members of UCSF’s University Professional and Technical Employees chapter said at a press conference Wednesday that they have requested a joint meeting with hospital leadership Thursday and a written response to their safety demands following the fatal stabbing of Alberto Rangel. The union will also hold a safety rally Thursday outside the hospital’s Potrero Street entrance.

Rangel, 51, died of his injuries Saturday after he was stabbed multiple times Dec. 4, according to police and prosecutors. The San Francisco Department of Public Health has said it will hire “an independent, outside security firm” to review safety and security at the hospital, “DPH clinics and other environments,” in the wake of the killing.

Rangel’s death is part of “a growing national crisis,” said UPTE-CWA 9119 Executive Vice President Matias Campos, making the UCSF social worker’s killing a shock but not a surprise.

“We know a lot of our members historically have expressed their concerns around safety at the workplace,” said Campos, whose union represents 22,000 health-care, research and education workers across the University of California system and counted Rangel as a member.

“This is not something new that our union has been calling for or demanding for,” he said. “We have been doing that for years — advocating for stronger safety measures, adequate safe staffing and case ratios, and protections for social workers.”

The San Francisco District Attorney’s Office charged Wilfredo Jose Tortolero Arriechi, 34, with murder and an enhancement that he personally used a knife in the commission of the crime. He was set to be arraigned Tuesday but will now be arraigned Dec. 16, according to court records. Multiple outlets reported Tuesday that his arraignment was delayed because he is being held in the psychiatric unit at San Francisco General Hospital.

Prosecutors allege that Tortolero Arriechi concealed a knife when he went to the hospital’s Ward 86 — its internationally renowned HIV/AIDS clinic run in conjunction with UCSF — to speak with a doctor. A social worker told him to leave, prosecutors said, and Rangel then accompanied Tortolero Arriechi to the elevator. Tortolero Arriechi then “grabbed the victim from behind and stabbed him numerous times,” prosecutors said Monday in a press release announcing the charges.

Campos and his fellow speakers Wednesday said Rangel’s death was the latest in a concerning trend.

The union leader pointed to a 2020 Bureau of Labor Statistics report that showed health-care and social-services workers were five times more likely to be the victims of workplace violence, and that health-care workers accounted for 73% of all nonfatal workplace injuries and illnesses from violence in 2018.

Almost 82% of the nearly 1,000 respondents in a 2024 National Nurses United report said they’d experienced some kind of violence at work in 2023, while nearly 46% said it increased from 2022.

Julette Suarez, a licensed clinical social worker at the hospital’s trauma-recovery center, said UPTE-CWA 9119’s safety demands included physical changes such as the installation of panic buttons, cameras, and metal detectors or similar screenings at patient entrances.

Enhance the Subsidies and Let the Insurance Industry Feed at the Federal Trough?

https://www.counterpunch.org/2025/11/10/enhance-the-subsidies-and-let-the-insurance-industry-feed-at-the-federal-trough/

ANA MALINOW

NOVEMBER 10, 2025

It’s helpful to think of the U.S. health care system like a pie made up of different slices (Figure). The largest (blue) slice is employer health insurance, which covers 160 million workers and their dependents; individual non-group insurance (in orange) provides 24 million individuals and their families with patchy insurance (including the enhanced subsidies); Medicaid (in yellow) covers 65 million poor and low-income adults, children, and seniors; Medicare (in red) pays for medical care for 60 million seniors and people with disabilities; the Veteran’s Health Administration (in bright green) provides the best socialized medicine in the nation to 9.1 million qualifying veterans; and that leaves the rest, approximately 28 million Americans, in the (purple) slice of the uninsured. It’s a patchwork arrangement that keeps Americans sliding from one slice to another their entire life until they turn 65, when they finally land on Medicare.

Figure: The U.S. patchwork health care arrangement

A colorful pie chart with textAI-generated content may be incorrect..jpeg

Source: Health Insurance Coverage of the Total Population | KFF; Veterans Health Administration; and ReportsSummary.pdf.

One thing about a pie chart, it’s simple geometry. If you make one slice bigger, by definition, you make another slice smaller.

Simple geometry was what President Obama had in mind, when he signed the Patient Protection and Affordable Care Act (ACA) into law in 2010. Despite the name, President Obama and Senator Max Baucus, then chair of the powerful Senate Finance Committee tasked with developing the legislation, gave up on making health care affordable (which would have required the elimination of health insurance companies) and instead concentrated on increasing the number of individuals with health insurance. It attempted, quite successfully, to shrink the slice of the uninsured.

To do this, the ACA included an employer mandate, expanding the slice of individuals covered by their employer, an individual mandate, increasing the slice of the non-group market, the expansion of Medicaid, which enlarged the slice of individuals who qualified, kept the Medicare and VA slices the same size, and presto! The slice of the uninsured shrank. As if by a miracle, the number of uninsured dropped from 50 million to 25 million almost (OK, it took four years to get through the courts) overnight. It was nothing more than simple geometry.

The non-group market

To understand the government shutdown, it’s important to delve deeper into the non-group, private health insurance (orange) slice of the health care pie, where 24 million individuals now get their health insurance.

The slice didn’t start out that large. Before the ACA, only 8 million individuals purchased private health insurance on their own. Unlike individuals who receive their private health insurance from their employer, who typically pays a significant chunk of the monthly premiums, leaving the employee to cover a smaller share of the premium, individuals in the non-group market paid the entire share of the monthly premiums on their own. In 2010, before the passage of the ACA, the average annual cost for health insurance for a family in the individual, non-group market according to America’s Health Insurance Plans, was almost $12,000 for premiums plus their deductible.

For the average worker, making a little over $49,000 in 2010, paying for health insurance meant spending 25% of their income on health insurance premiums (not including the yearly deductible). Expensive health insurance was then, and remains today, the major driver of uninsurance.

Enter the ACA and the individual mandate, which required everyone to have health insurance (either public or private) or be faced with a hefty fine.

The architects of the ACA recognized that the government could not possibly mandate the average worker to spend 25% of their income on health insurance, or worse yet, a worker making minimum wage (those least likely to be covered by their employer), making $15,000 annually in 2010, to spend practically their entire income on health insurance.

To get around this inconvenient reality, low-income individuals outside of the group market would now be able to purchase their private health insurance through a “Marketplace” where the government would (like the employer in the group market) pay a share of the monthly premium. The government share, based on the individual’s income, became known as the “subsidy” or a premium tax credit, a complicated system of advanced premium tax credits (APTCs) based on estimated income which must be accounted for when individuals file their federal income taxes. If the APTC was less than the estimated income, the difference is received as a tax credit used to lower the amount of taxes owed. If the advanced payments were greater than the final income received that year, some or all of the excess would need to be repaid.

The lower low-income workers would receive a larger subsidy from the government, while higher low-income workers (up to 400% of the federal poverty level), would receive a smaller federal subsidy to cover their health insurance premiums. Individuals and their families could choose coverage from “metal tiers” that went from crappy (Bronze, low premiums, high deductible) to good (Platinum, high premiums and lowish deductible).

While the government paid the subsidy to make the premiums cost no more than 8% of the worker’s paycheck, the government did a little something about the deductible, which could be thousands of dollars every year, and had to be met before the insurance company would start paying claims.

The “little something” could lower the cost of variable costs when using health insurance (the whole point of having health insurance) such as a deductible. It applied only to individuals and their families with annual incomes between 100-250% of the federal poverty level and only for a Silver plan. This created a high-stakes decision for very low-income families. Do they go for the Bronze plan with low monthly premiums but very high deductible, gambling they will not need health care that year, or go for the Silver plan with the higher monthly premiums but reduced deductible?

The size of the slice grew from 8 million to 11 million individuals and their families.

When President Trump came into office the first time, he and Congress eliminated the individual mandate, but did nothing to make health care more affordable. Now it was legal to be uninsured again.

While people struggled to pay their medical bills, one sector of the economy that was not struggling was the insurance industry, which was collecting the subsidies every year from Uncle Sam, plus the premiums that individuals and their families paid every month, plus the yearly deductibles. Health insurance companies collected billions before they ever had to pay out one penny for medical claims.

Then came the pandemic.

COVID and the enhanced subsidies

In March 2021, the Democrats pushed through a two-year expansion of the Affordable Care Act in the COVID-19 relief bill. The bill enhanced the Marketplace subsidies, meaning the federal government would now pick up a greater share of the monthly premium. Suddenly, people found themselves paying $0 monthly premiums. Even workers who had traditionally been closed out of the Marketplace because they “made too much money” (i.e., above 400 percent of the federal poverty level, which in 2021, for a couple, was a little over $69,000 per year) now qualified for cheap health insurance plans with “enhanced subsidies.”

There were just three caveats.

One: Annual deductibles continued to be extraordinarily high, as high as $14,700 for a family of four whose income was at 250% of the federal poverty level. So yes, while people had “health insurance” on paper, it left people in medical debt if they sought medical care or the option to avoid care altogether, even as they and the federal government continued to pay the premiums.

Two: The legislation directed some $20 billion more to health insurance companies by making enhanced premium subsidies for more consumers who now qualified for plans.

Three: The enhanced subsidies would expire December 2025.

Even if substandard, these plans did mean a lifeline to millions of Americans who lost their jobs during the pandemic and found themselves without health insurance. The enhanced subsidies expanded the non-group market to 24 million Americans and kept the uninsured slice from ballooning out of control (as did continuous enrollment in Medicaid, but that’s another story).

Unfortunately, instead of using a once-in-a-lifetime pandemic to ensure health care as a human right to everyone and expand Medicare to all, Congress worked double duty to expand Medicaid, enhance the subsidies and keep the private health insurance industry feeding at the federal trough.

While the government was paying larger shares of health insurance premiums for more people, health insurance premiums continued to rise without pause. The federal government could have mandated price controls on the subsidies they were paying, but of course, nothing of the sort happened. From 2014 (when the Marketplace was launched) to 2025, health insurance premiums increased 60%, with the federal government subsidizing the growth. Today, gross margins per enrollee in the Marketplace are 15% higher than in the group, employer market.

Little wonder that the Congressional Budget Office recently predicted that expanding the enhanced subsidies in the Marketplace will cost $350 billion over the next 10 years.

If enhanced subsidies expire, Marketplace enrollees (making 100-400% of the federal poverty level) will continue to qualify for a pre-pandemic subsidy, while others will lose eligibility altogether. Because health insurance has been rising (costs that individuals in the Marketplace might not have been aware of), and because insurers in the Marketplace are proposing to raise their rates by a median of 18% next year, millions will be hit with a “double whammy” of losing subsidies and being on the hook for rising premiums.

The government shutdown

Democrats, saying they are fighting to protect health care for Americans, refuse to pass a budget bill that does not expand enhanced subsidies permanently. They are joined by a bevy of predictable allies, including the American Health Insurance Association, the Federation of American Hospitals, and AARP, which sells Medicare Advantage plans.

Republicans, seeking a bill to temporarily extend federal spending at current levels without any add-ons (after slashing $1 trillion from the social safety net to pay for billionaire tax cuts), say the Democrats want to spend billions of federal dollars on undocumented immigrants, even though federal law prohibits Marketplace subsidies from being used by undocumented immigrants (see the amount of paperwork required above).

As a result of the intransigence in both parties, the federal government shut down in the early morning of October 1 after Congress failed to pass funding for federal programs and services.

Instead of shutting down the government and demanding real health reform, Democrats are quibbling over subsidies that keep Americans underinsured and in medical debt and importantly, continue pouring billions into the till of the health insurance industry.

Between a rock and a hard place

Should single payer activists support Democrats, and allow 24 million people to pay for some form of health insurance but enrich the very corporations we are fighting? Or do we turn our back on millions of Americans and deny a predatory, rapacious industry another penny?

The lesser of the two evils is to support a temporary extension of the enhanced subsidies and place strict price controls on what insurance companies can charge the government. If every crisis presents an opportunity, let’s use this one to pass a national, single payer health care system that guarantees health care to everyone and removes all profit from health care. Nothing short of this can heal this nation.

Dr. Ana Malinow is a retired pediatrician, who has dedicated her career to serving immigrant, refugee, and marginalized children. She has written extensively on U.S. health care policy. She co-leads National Single Payer.

For more information:

https://nationalsinglepayer.com

Added to the calendar on Tue, Jan 13, 2026 9:52PM

Add Your Comments

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network