From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

Protest Medicare/Medicaid Cuts On 60th Anniversary Of Medicare At Pier 33 & Bridges Plaza

Date:

Wednesday, July 30, 2025

Time:

12:00 PM

-

3:00 PM

Event Type:

Protest

Organizer/Author:

National Single Payer

Location Details:

Press Conference Rally at Pier 33 Alcatraz At 12 noon pm

Rally At Harry Bridges Plaza 2-4 PM

Rally At Harry Bridges Plaza 2-4 PM

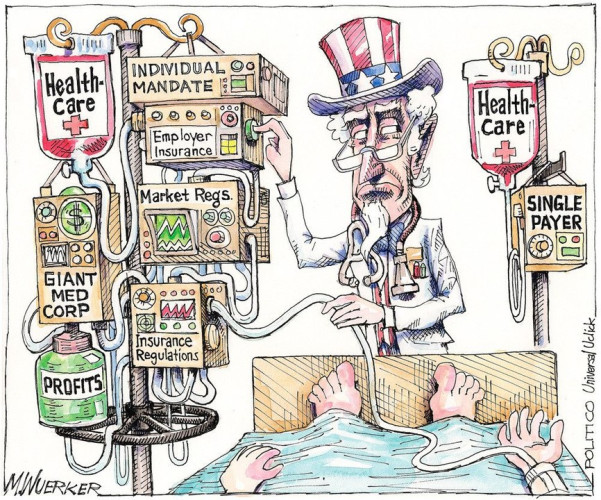

Healthcare Not Prisons

Join a national day of action on 60th anniversary of Medicare. The massive cuts in medicaid and privatization of medicare will mean that millions of people in California and throughout the country will be shut off from healthcare. We will be have a rally and press conference at Pier 33 and Alcatraz Tours to protest Trump's plan to return Alcatraz to be a functioning prison. He plans to spend hundreds of millions to turn this major tourist site for a prison. The recently passed Trump bill will provide $130 billion for more ICE and prisons throughout the country.

At the same time he is cutting a trillion dollars from healthcare.

We will rally at Harry Bridges Plaza next to the Ferry Building and will speak out and education about the need for national single payer to get rid of the control of the insurance companies and billionaires from control of this industry.

Revealed: UnitedHealth secretly paid nursing homes to reduce hospital transfers-Killing For Profits

https://www.theguardian.com/us-news/2025/may/21/unitedhealth-nursing-homes-payments-hospital-transfers

A Guardian investigation finds insurer quietly paid facilities that helped it gain Medicare enrollees and reduce hospitalizations. Whistleblowers allege harm to residents

US nursing home employees: do you have information about UnitedHealth’s nursing home practices?

George Joseph

Wed 21 May 2025 12.00 CEST

UnitedHealth Group, the nation’s largest healthcare conglomerate, has secretly paid nursing homes thousands in bonuses to help slash hospital transfers for ailing residents – part of a series of cost-cutting tactics that has saved the company millions, but at times risked residents’ health, a Guardian investigation has found.

Those secret bonuses have been paid out as part of a UnitedHealth program that stations the company’s own medical teams in nursing homes and pushes them to cut care expenses for residents covered by the insurance giant.

In several cases identified by the Guardian, nursing home residents who needed immediate hospital care under the program failed to receive it, after interventions from UnitedHealth staffers. At least one lived with permanent brain damage following his delayed transfer, according to a confidential nursing home incident log, recordings and photo evidence.

a sign on a building reads 'UnitedHealthcare'

UnitedHealth Group shares plunge after report of Medicare fraud inquiry

Read more

“No one is truly investigating when a patient suffers harm. Absolutely no one,” said one current UnitedHealth nurse practitioner who recently filed a congressional complaint about the nursing home program. “These incidents are hidden, downplayed and minimized. The sense is: ‘Well, they’re medically frail, and no one lives for ever.’”

The Guardian’s investigation is based on thousands of confidential corporate and patient records obtained through sources, public records requests and court files, interviews with more than 20 current and former UnitedHealth and nursing home employees, and two whistleblower declarations submitted to Congress this month through the non-profit legal group Whistleblower Aid.

The documents and sources provide a never-before-seen window into the company’s successful effort to insert itself into the day-to-day operations of nearly 2,000 nursing homes in small towns and urban commercial strips across the nation – an approach which has helped UnitedHealth secure a vast stream of federal dollars from Medicare Advantage plans that cover more than 55,000 long-term nursing home residents.

UnitedHealth said the suggestion that its employees have prevented hospital transfers “is verifiably false”. It said its bonus payments to nursing homes help prevent unnecessary hospitalizations that are costly and dangerous to patients and that its partnerships with nursing homes improve health outcomes.

Under Medicare Advantage, insurers collect lump sums from the federal government to cover seniors’ care. But the less insurers spend on care, the more they have for potential profit – an opportunity that UnitedHealth higher-ups have systematically sought to exploit when it comes to long-term nursing home residents.

To reduce residents’ hospital visits, UnitedHealth has offered nursing homes an array of financial sweeteners that sounded more like they came from stockbrokers than medical professionals.

Over the past seven years, the company has shelled out “Premium Dividend” and “Shared Savings” payments that boosted nursing homes’ bottom lines. Through its “Quality and Shared Risk” program, UnitedHealth offered an even bigger cut to nursing homes that drove down medical spending, but threatened to claw back money from those that didn’t, according to former employees and internal corporate documents.

One term that UnitedHealth executives obsessed over was “admits per thousand” – APK for short. It was a measure of the rate that nursing homes sent their residents to the hospital. Under the “Premium Dividend” program, a low APK qualified a nursing home for the various bonus payments the insurer offered. A high APK meant that a nursing home received nothing.

“APK drove everything,” said one former national UnitedHealth executive who worked on the initiative with nursing homes in more than two dozen states and spoke about the confidential contracts on the condition of anonymity. “You gain profitability by denying care, and when profitability suffers for the shareholders, that’s when people get crazy and do things that are not appropriate.”

protesters hold signs in support of luigi mangione

View image in fullscreen

Supporters of Luigi Mangione outside Manhattan criminal court as he appeared for his hearing on state murder and terrorism charges on 21 February. Photograph: Mostafa Bassim/Anadolu/Getty Images

The revelations come at a time of crisis for UnitedHealth, which became the subject of public outrage after December’s fatal shooting of Brian Thompson, a top executive at the company, and the arrest of a suspect named Luigi Mangione.

The killing reignited concerns over the healthcare giant’s Medicare windfalls and denials of care to patients. But a full accounting of UnitedHealth’s cost-cutting push inside nursing homes has not previously surfaced amid government and media investigations into the company’s conduct.

Cost-cutting tactics

The secret bonuses were just one of many maneuvers UnitedHealth devised to track and cut expenses in its nursing home initiative.

Internal emails show, for example, that UnitedHealth supervisors gave their teams “budgets” showing how many hospital admissions they had “left” to use up on nursing home patients.

The company also monitored nursing homes that had smaller numbers of patients with “do not resuscitate” – or DNR – and “do not intubate” orders in their files. Without such orders, patients are in line for certain life-saving treatments that might lead to costly hospital stays.

Two current and three former UnitedHealth nurse practitioners told the Guardian that UnitedHealth managers pressed nurse practitioners to persuade Medicare Advantage members to change their “code status” to DNR even when patients had clearly expressed a desire that all available treatments be used to keep them alive.

text from documents

View image in fullscreen

“They’re pretending to make it look like it’s in the best interest of the member,” another current UnitedHealth nurse practitioner said. “But it’s really not.”

In response to questions, UnitedHealth said its nursing home initiative improves care for older residents by providing “on-site nurse practitioners, tailored care plans for chronic conditions, and enhanced communication between staff, families and providers”.

The company denied that it had prevented hospital transfers or inappropriately pushed patients to change their code status to DNR.

The program’s cost-cutting schemes were only possible because of the sprawling nature of UnitedHealth, a $300bn-plus conglomerate which has grown into one of the world’s biggest companies thanks to its relentless efforts to embed itself into nearly every corner of the healthcare industry. UnitedHealth’s insurance arm covers millions more Medicare Advantage seniors than any of its rivals, and another subsidiary, Optum, employs or affiliates with tens of thousands of doctors and nurse practitioners.

When nursing homes under the bonus program allowed medical teams from one UnitedHealth subsidiary to work in their facilities, they allowed the corporate giant to influence critical healthcare decisions for residents, which had a direct impact on the insurance side of its business.

a sign on a building reads 'UnitedHealthcare'

US justice department opens civil fraud investigation into UnitedHealthcare

Read more

The Guardian’s reporting also found that the program offered nursing homes even larger sums for every senior enrolled in the insurer’s offerings for long-term nursing home residents, which are called “Institutional Special Needs Plans”. In some cases, these payments incentivized nursing homes to leak confidential resident records to UnitedHealth sales teams so they could directly solicit elderly residents and their families, according to a whistleblower lawsuit currently being fought in federal court in Georgia as well as internal nursing home records and interviews with more than a dozen current and former nursing home employees and UnitedHealth salespeople.

One former UnitedHealth employee in Georgia admitted to the Guardian that she got nursing home staff to leak her confidential resident records then backdated permission-to-contact forms to circumvent federal rules meant to protect seniors from aggressive sales pitches. The employee was fired after failing to meet her sales quota, according to a former colleague.

After one nursing home near Savannah, Georgia, disclosed confidential patient records to UnitedHealth, families complained that their loved ones had been shifted on to the company’s Medicare Advantage plan even though they lacked the cognitive ability to make such decisions, according to a former UnitedHealth executive, federal court filings in Georgia and leaked patient files reviewed by the Guardian.

All told, the various payments that came with increasing UnitedHealth enrollments and minimizing medical expenses could add up to hundreds of thousands of dollars annually for a typical midsize nursing home, sources said.

But the nursing home residents, who had signed up for UnitedHealth’s Medicare Advantage program and whose federal dollars were financing the program, did not know about the confidential incentive payments and anti-hospitalization tactics affecting their care.

UnitedHealth declined to answer questions about how much it has paid out to nursing homes through the secret contract clauses. The company said its payments incentivize high-quality outcomes for residents and reward efforts that lead to improved care.

Maxwell Ollivant, a former UnitedHealth nurse practitioner, filed a congressional declaration this month with help from Whistleblower Aid, asking the federal government to hold the healthcare giant accountable.

In an interview with the Guardian – his first-ever public comment on the nursing home initiative – Ollivant urged lawmakers to make sure that UnitedHealth was “not skimping out on care” and that patients were not “signing up for a service and not receiving the service when the time comes”.

Ollivant previously filed a lawsuit in federal court in Washington state accusing UnitedHealth of withholding necessary services to nursing home residents, making their requests for Medicare payments violations of the federal False Claims Act. In 2023, the nurse practitioner dropped the suit after the Department of Justice declined to intervene. His congressional declaration provides new details of his experience.

In a statement, UnitedHealth said Ollivant “lacks both the necessary data and expertise” to assess the effectiveness of its programs. “We stand firmly behind the integrity of our programs, which consistently receive high satisfaction ratings from our members,” it said.

Dubious diagnoses, delayed hospitalizations

UnitedHealth pitches its nursing home initiative as a positive for long-term residents. It provides them access to UnitedHealth nurse practitioners via in-person visits as well as to remote medical professionals who provide guidance to facility nurses at night and on weekends.

This “enhanced care coordination”, as the company puts it, is supposed to help reduce unnecessary hospitalizations, which are costly for UnitedHealth and can expose patients to additional complications.

In several cases identified by the Guardian, the company’s insertion of itself into nursing home emergency protocols helped delay or avert transfers for patients who could have benefited from immediate hospital care.

UnitedHealthcare building in Phoenix, Arizona.

View image in fullscreen

UnitedHealthcare building in Phoenix, Arizona. Composite: Patrick T Fallon/AFP/Getty Images

In one incident from 2019, a remote UnitedHealth medical provider working for the program received a report shortly after midnight about a nursing home resident in Renton, Washington, who was slurring her words and unable to move her arm – textbook stroke symptoms.

In stroke cases, every minute counts. When blood flow to the brain is blocked or interrupted, brain cells quickly die. The sooner patients get to the hospital, the better the chance doctors have to prevent long-term neurological damage.

In this case, the nurse at her nursing home reported to UnitedHealth that it looked like a stroke, according to an incident log. But instead of greenlighting an immediate hospitalization for a possible stroke, the remote UnitedHealth employee suggested the resident might be suffering from a less serious condition called a transient ischemic attack (TIA), a temporary loss of brain function caused by blood flow blockage.

The remote employee then advised the nurse to run a blood test and update the company again in four hours, confidential UnitedHealth records show.

The patient’s independent primary care doctor told the Guardian she was never informed of this failure to transfer her patient.

“I would have wanted them to contact me right away so that I could have made a decision,” she said, speaking on the condition of anonymity to discuss sensitive patient matters. “The time frame matters.”

The independent doctor also said she was disturbed by the remote UnitedHealth employee’s working diagnosis, which called for ruling out a TIA, rather than a stroke. The remote employee was an early-career nurse practitioner, not a physician.

“Their diagnosis says TIA, [but] nobody can say that so early,” the patient’s doctor said.

In another incident that year, a nursing home nurse in Puyallup, Washington, delayed hospitalizing a resident also exhibiting potential stroke symptoms because of UnitedHealth protocols that pushed facility staff to wait for guidance from the company.

According to confidential nursing home records obtained by the Guardian, the nurse phoned a remote UnitedHealth provider, who was unsure about what to do and failed to call for an immediate transfer. Tired of waiting for a callback, the nurse finally bypassed the remote provider and called an independent doctor, who ordered the patient to be transferred.

But the delay meant that about an hour passed before the resident was actually taken to the hospital, which was only a few minutes away from his facility.

After the belated hospitalization, the patient suffered permanent verbal slurring and facial droop on the right side of his face, audio recordings and photos obtained by the Guardian show.

Citing confidentiality rules, UnitedHealth declined to comment on the specific patient cases. But the company noted that it does not prevent nursing homes themselves from contacting residents’ independent doctors, and that hospitalization decisions can depend on many factors including a patient’s goals of care, symptoms and the input of their care team.

UnitedHealth’s pressure on nursing home staff

UnitedHealth denied that its employees prevented hospital transfers and said it was the responsibility of the treating physician and the facility to decide on a patient’s best course of care.

But in practice, the company’s tactics put pressure on facility nurses to turn over patient care decisions to UnitedHealth staffers, according to internal documents and interviews with current and former UnitedHealth medical providers.

“There was never any caveat, given, like, ‘It’s up to you all,’” said one former UnitedHealth doctor involved in the program. Nurses at the long-term care facilities “were calling the nurse practitioner or on-call provider who was responsible. The implication was that they were calling for advice that was meant to be followed.”

“A lot of times the nurses want to send people out and we have to go in and try to stop it,” said another current UnitedHealth nurse practitioner, who also spoke to the Guardian anonymously citing fears of retaliation. “And if we don’t, it’s on us. They take us out on to the carpet.”

In one patient case identified by the Guardian, nursing home staff sent a resident to the hospital because she was found unresponsive, drooling and with a “slant to the side” – possible stroke symptoms. She was admitted to the intensive care unit for a brain bleed, according to a UnitedHealth email reviewed by the Guardian.

But after the incident, instead of praising the facility team for the prompt hospitalization, a UnitedHealth manager alerted her subordinates that the facility team had bypassed the company’s protocol, failing to contact UnitedHealth’s remote on-call team first to receive guidance.

The manager met with the nursing home’s director of nursing services, and scheduled training to re-educate the facility’s nurses, the email shows.

UnitedHealth notes that unnecessary hospitalizations can expose patients to pressure injuries, falls and other complications. In response to questions from the Guardian, UnitedHealth pointed to one 2019 study which heralded the program’s success in reducing hospitalizations and noted the potential harms of hospital care.

But in an interview with the Guardian, Ollivant, the former UnitedHealth nurse practitioner turned whistleblower, argued such analyses fail to account for the negative health outcomes that patients suffer from missing hospital care.

“How many of those people were further harmed because they never received the care that they needed?” he said. “When you just look at the percentage reductions in hospitalizations, it doesn’t say anything about patient outcomes.”

A plan of care, an ailing patient

Kevin Keep never knew – until the Guardian called him last month and told him – that his father had suffered a possible stroke at a nursing home that partnered with UnitedHealth.

On the evening of 23 February 2019, a UnitedHealth remote employee received a report about Keep’s father, Donald Keep, a retired auto mechanic with dementia and an amputated leg living at a nursing home in Bremerton, Washington.

man on his wedding day

View image in fullscreen

Donald Keep on his wedding day. Photograph: Kevin Keep

On that day, Keep was experiencing forgetfulness and drooping on the right side of his face – “possible stroke symptoms”, according to a confidential UnitedHealth incident log.

But instead of sending the octogenarian straight to the hospital, the remote employee referred to a plan of care that called for bloodwork and giving Keep an aspirin – a course of action which one former UnitedHealth doctor said “doesn’t make sense”, given the risk of brain damage.

“That’s not useful when it might be a stroke,” said the doctor, who spoke on the condition of anonymity to comment on Keep’s confidential patient records that he reviewed at the request of the Guardian. “What they really need is a physical exam and an MRI of the brain, and it needs to be done expeditiously.”

The incident log, which doesn’t mention a hospital transfer, suggests that the UnitedHealth team didn’t treat the case with the urgency that a possible stroke would require.

Keep’s symptoms were logged shortly before 10pm on a Saturday night. The next afternoon, a UnitedHealth employee emailed the company’s nurse practitioners a follow-up note to look into what was wrong with Keep.

The email lists the proposed work-up as being for a “TIA” – the transient, less serious neurological condition, not a stroke.

As of 4pm on that Sunday, more than 18 hours after Keep was found with his face drooping, the work-up was still listed as “pending”.

Citing patient confidentiality, UnitedHealth did not respond to an inquiry about whether the retiree was ever sent to the hospital.

Hannah Recht contributed data reporting

Tomorrow, part two of UnitedHealth investigation: A tale of three whistleblowers

UnitedHealth’s Revenues Rise, in First Earnings Report Since C.E.O.’s Killing

Revenues for UnitedHealth Group amounted to $100.8 billion for the fourth quarter

But high medical costs contributed to results that disappointed Wall Street, and the company’s stock fell on the news that it had made less than analysts expected.

https://www.nytimes.com/2025/01/16/health/unitedhealth-earnings-report-ceo-murder.html?searchResultPosition=1

An exterior view of a building, with a large white sign in the foreground that reads "UnitedHealthcare."

UnitedHealth Group’s campus in Minnetonka, Minn. Earnings reported Thursday were the company’s first since its chief executive was killed.Credit...Jim Mone/Associated Press

Danielle Kaye.png

By Danielle Kaye

Jan. 16, 2025

UnitedHealth Group reported on Thursday that it earned less than expected this past quarter, citing higher medical costs and pressure on its insurance division at a time when the company is still reeling from the shocking murder of a top executive last month.

Revenues for UnitedHealth Group amounted to $100.8 billion for the fourth quarter, below what analysts had predicted but still 6.8 percent higher than in the same quarter the year before. The company’s full-year revenue for 2024 rose to $400.3 billion. For UnitedHealthcare, the insurance division, full-year revenue increased to $298.2 billion, up 6 percent from 2023.

The results were the company’s first since Brian Thompson, the chief executive of UnitedHealthcare, was gunned down in front of a Midtown Manhattan hotel.

The murder unleashed public outrage aimed at big health insurers, over lack of access to health care and denials of coverage and insurance claims.

Some shareholders have urged UnitedHealth to issue a report on its practices that “limit or delay access to health care.”

Andrew Witty, UnitedHealth Group’s chief executive, said on a call with analysts on Thursday that frustrations about claims, including delays in receiving care and coverage, were “key areas for us to work hard at to improve.”

A successor to Mr. Thompson has not been named yet. Mr. Witty did not share details about filling the post, nor did he directly address the recent shareholder campaign.

But he and other executives discussed the loss of Mr. Thompson at the top of the call.

“He devoted his time to helping make the health system work better for all of the people we’re privileged to serve,” Mr. Witty said.

UnitedHealth’s results, which disappointed Wall Street, in many ways reflected broader trends and lingering issues for the industry. For several quarters, U.S. health insurers have taken hits to their earnings from high medical expenses and a tightening of government payment policies.

John Rex, the company’s chief financial officer, pointed to cutbacks in government rates in the payment system for Medicare Advantage program, the private insurance arm of the federal coverage for people 65 and over. UnitedHealth has substantial business in these Medicare private plans.

Medicare Advantage performance has declined throughout the industry recently, partly because of regulatory changes meant to prevent overcharging and following increased health spending among some older populations.

Mr. Witty also said there were costs associated with changes in Medicaid, the federal-state insurance program for the poor.

The company’s medical cost ratio, a measure of the cost of providing care, came in higher than expected in the most recent quarter, which could add fuel to investors’ concerns that increased costs for delivery of care might linger, said John Boylan, an analyst at Edward Jones, an investment firm.

UnitedHealth, however, kept its full-year guidance for 2025 intact, unaltered by recent pressure. Analysts at Morgan Stanley said in a research note that the company had set “reasonably prudent targets” for this year.

“Overall, our view is that United is well positioned to navigate the evolving health care landscape due to its diversified business model,” Mr. Boylan said.

UnitedHealth’s stock fell 6 percent on Thursday as investors digested the weaker-than-expected results. UnitedHealth’s results, often seen as a bellwether for performance across the industry, pushed down shares of its rivals, including CVS Health, which is the parent of the insurer Aetna.

UnitedHealth Group also owns Optum Rx, one of the country’s largest pharmacy benefit managers, which employers and government programs hire to oversee their prescription-drug benefits.

Optum Rx has faced scrutiny from regulators over concerns that it has raised drug prices, prioritizing its own interests above those of patients, employers and taxpayers. Just this week, the Federal Trade Commission released a report detailing how P.B.M.s could be inflating drug costs.

The agency criticized Optum Rx and two other major benefit managers — CVS Health’s Caremark and Cigna’s Express Scripts — for raising prices on generic drugs for cancer, heart disease and other illnesses as high as 1,000 percent of national average costs.

Mr. Witty, the UnitedHealth Group chief executive, defended Optum’s practices, stressing that 98 percent of the rebates were passed to customers. By 2028, he said, all rebates would be passed on. Drug prices in the United States, Mr. Witty argued, are “de novo set too high relative to any other price in the world,” and shifted the blame to drug companies.

“The P.B.M. acts on behalf of the ultimate payer — the employer, the union, the state,” Mr. Witty told analysts.

Mr. Witty did not address investigations by the Justice Department or lawsuits seeking to block its proposed acquisition of Amedsys, a large home care and hospice company.

Beyond rising medical costs and increasing use of health care services, UnitedHealth executives pointed to the widespread ransomware attack in 2024 that weighed on the company’s full-year profits. The cyberattack forced the shutdown of the company’s sprawling billing and payment system, Change Healthcare. The company has estimated that the data breach of health and privacy information affected more than 100 million people, and said this week that a review of personal information involved in the incident was “substantially complete.”

Luigi Mangione, 26, has been charged with multiple state and federal counts of murder as well as weapons and stalking offenses. He has pleaded not guilty.

UnitedHealth and the police have said that neither he nor his parents had medical insurance through UnitedHealth.

Join a national day of action on 60th anniversary of Medicare. The massive cuts in medicaid and privatization of medicare will mean that millions of people in California and throughout the country will be shut off from healthcare. We will be have a rally and press conference at Pier 33 and Alcatraz Tours to protest Trump's plan to return Alcatraz to be a functioning prison. He plans to spend hundreds of millions to turn this major tourist site for a prison. The recently passed Trump bill will provide $130 billion for more ICE and prisons throughout the country.

At the same time he is cutting a trillion dollars from healthcare.

We will rally at Harry Bridges Plaza next to the Ferry Building and will speak out and education about the need for national single payer to get rid of the control of the insurance companies and billionaires from control of this industry.

Revealed: UnitedHealth secretly paid nursing homes to reduce hospital transfers-Killing For Profits

https://www.theguardian.com/us-news/2025/may/21/unitedhealth-nursing-homes-payments-hospital-transfers

A Guardian investigation finds insurer quietly paid facilities that helped it gain Medicare enrollees and reduce hospitalizations. Whistleblowers allege harm to residents

US nursing home employees: do you have information about UnitedHealth’s nursing home practices?

George Joseph

Wed 21 May 2025 12.00 CEST

UnitedHealth Group, the nation’s largest healthcare conglomerate, has secretly paid nursing homes thousands in bonuses to help slash hospital transfers for ailing residents – part of a series of cost-cutting tactics that has saved the company millions, but at times risked residents’ health, a Guardian investigation has found.

Those secret bonuses have been paid out as part of a UnitedHealth program that stations the company’s own medical teams in nursing homes and pushes them to cut care expenses for residents covered by the insurance giant.

In several cases identified by the Guardian, nursing home residents who needed immediate hospital care under the program failed to receive it, after interventions from UnitedHealth staffers. At least one lived with permanent brain damage following his delayed transfer, according to a confidential nursing home incident log, recordings and photo evidence.

a sign on a building reads 'UnitedHealthcare'

UnitedHealth Group shares plunge after report of Medicare fraud inquiry

Read more

“No one is truly investigating when a patient suffers harm. Absolutely no one,” said one current UnitedHealth nurse practitioner who recently filed a congressional complaint about the nursing home program. “These incidents are hidden, downplayed and minimized. The sense is: ‘Well, they’re medically frail, and no one lives for ever.’”

The Guardian’s investigation is based on thousands of confidential corporate and patient records obtained through sources, public records requests and court files, interviews with more than 20 current and former UnitedHealth and nursing home employees, and two whistleblower declarations submitted to Congress this month through the non-profit legal group Whistleblower Aid.

The documents and sources provide a never-before-seen window into the company’s successful effort to insert itself into the day-to-day operations of nearly 2,000 nursing homes in small towns and urban commercial strips across the nation – an approach which has helped UnitedHealth secure a vast stream of federal dollars from Medicare Advantage plans that cover more than 55,000 long-term nursing home residents.

UnitedHealth said the suggestion that its employees have prevented hospital transfers “is verifiably false”. It said its bonus payments to nursing homes help prevent unnecessary hospitalizations that are costly and dangerous to patients and that its partnerships with nursing homes improve health outcomes.

Under Medicare Advantage, insurers collect lump sums from the federal government to cover seniors’ care. But the less insurers spend on care, the more they have for potential profit – an opportunity that UnitedHealth higher-ups have systematically sought to exploit when it comes to long-term nursing home residents.

To reduce residents’ hospital visits, UnitedHealth has offered nursing homes an array of financial sweeteners that sounded more like they came from stockbrokers than medical professionals.

Over the past seven years, the company has shelled out “Premium Dividend” and “Shared Savings” payments that boosted nursing homes’ bottom lines. Through its “Quality and Shared Risk” program, UnitedHealth offered an even bigger cut to nursing homes that drove down medical spending, but threatened to claw back money from those that didn’t, according to former employees and internal corporate documents.

One term that UnitedHealth executives obsessed over was “admits per thousand” – APK for short. It was a measure of the rate that nursing homes sent their residents to the hospital. Under the “Premium Dividend” program, a low APK qualified a nursing home for the various bonus payments the insurer offered. A high APK meant that a nursing home received nothing.

“APK drove everything,” said one former national UnitedHealth executive who worked on the initiative with nursing homes in more than two dozen states and spoke about the confidential contracts on the condition of anonymity. “You gain profitability by denying care, and when profitability suffers for the shareholders, that’s when people get crazy and do things that are not appropriate.”

protesters hold signs in support of luigi mangione

View image in fullscreen

Supporters of Luigi Mangione outside Manhattan criminal court as he appeared for his hearing on state murder and terrorism charges on 21 February. Photograph: Mostafa Bassim/Anadolu/Getty Images

The revelations come at a time of crisis for UnitedHealth, which became the subject of public outrage after December’s fatal shooting of Brian Thompson, a top executive at the company, and the arrest of a suspect named Luigi Mangione.

The killing reignited concerns over the healthcare giant’s Medicare windfalls and denials of care to patients. But a full accounting of UnitedHealth’s cost-cutting push inside nursing homes has not previously surfaced amid government and media investigations into the company’s conduct.

Cost-cutting tactics

The secret bonuses were just one of many maneuvers UnitedHealth devised to track and cut expenses in its nursing home initiative.

Internal emails show, for example, that UnitedHealth supervisors gave their teams “budgets” showing how many hospital admissions they had “left” to use up on nursing home patients.

The company also monitored nursing homes that had smaller numbers of patients with “do not resuscitate” – or DNR – and “do not intubate” orders in their files. Without such orders, patients are in line for certain life-saving treatments that might lead to costly hospital stays.

Two current and three former UnitedHealth nurse practitioners told the Guardian that UnitedHealth managers pressed nurse practitioners to persuade Medicare Advantage members to change their “code status” to DNR even when patients had clearly expressed a desire that all available treatments be used to keep them alive.

text from documents

View image in fullscreen

“They’re pretending to make it look like it’s in the best interest of the member,” another current UnitedHealth nurse practitioner said. “But it’s really not.”

In response to questions, UnitedHealth said its nursing home initiative improves care for older residents by providing “on-site nurse practitioners, tailored care plans for chronic conditions, and enhanced communication between staff, families and providers”.

The company denied that it had prevented hospital transfers or inappropriately pushed patients to change their code status to DNR.

The program’s cost-cutting schemes were only possible because of the sprawling nature of UnitedHealth, a $300bn-plus conglomerate which has grown into one of the world’s biggest companies thanks to its relentless efforts to embed itself into nearly every corner of the healthcare industry. UnitedHealth’s insurance arm covers millions more Medicare Advantage seniors than any of its rivals, and another subsidiary, Optum, employs or affiliates with tens of thousands of doctors and nurse practitioners.

When nursing homes under the bonus program allowed medical teams from one UnitedHealth subsidiary to work in their facilities, they allowed the corporate giant to influence critical healthcare decisions for residents, which had a direct impact on the insurance side of its business.

a sign on a building reads 'UnitedHealthcare'

US justice department opens civil fraud investigation into UnitedHealthcare

Read more

The Guardian’s reporting also found that the program offered nursing homes even larger sums for every senior enrolled in the insurer’s offerings for long-term nursing home residents, which are called “Institutional Special Needs Plans”. In some cases, these payments incentivized nursing homes to leak confidential resident records to UnitedHealth sales teams so they could directly solicit elderly residents and their families, according to a whistleblower lawsuit currently being fought in federal court in Georgia as well as internal nursing home records and interviews with more than a dozen current and former nursing home employees and UnitedHealth salespeople.

One former UnitedHealth employee in Georgia admitted to the Guardian that she got nursing home staff to leak her confidential resident records then backdated permission-to-contact forms to circumvent federal rules meant to protect seniors from aggressive sales pitches. The employee was fired after failing to meet her sales quota, according to a former colleague.

After one nursing home near Savannah, Georgia, disclosed confidential patient records to UnitedHealth, families complained that their loved ones had been shifted on to the company’s Medicare Advantage plan even though they lacked the cognitive ability to make such decisions, according to a former UnitedHealth executive, federal court filings in Georgia and leaked patient files reviewed by the Guardian.

All told, the various payments that came with increasing UnitedHealth enrollments and minimizing medical expenses could add up to hundreds of thousands of dollars annually for a typical midsize nursing home, sources said.

But the nursing home residents, who had signed up for UnitedHealth’s Medicare Advantage program and whose federal dollars were financing the program, did not know about the confidential incentive payments and anti-hospitalization tactics affecting their care.

UnitedHealth declined to answer questions about how much it has paid out to nursing homes through the secret contract clauses. The company said its payments incentivize high-quality outcomes for residents and reward efforts that lead to improved care.

Maxwell Ollivant, a former UnitedHealth nurse practitioner, filed a congressional declaration this month with help from Whistleblower Aid, asking the federal government to hold the healthcare giant accountable.

In an interview with the Guardian – his first-ever public comment on the nursing home initiative – Ollivant urged lawmakers to make sure that UnitedHealth was “not skimping out on care” and that patients were not “signing up for a service and not receiving the service when the time comes”.

Ollivant previously filed a lawsuit in federal court in Washington state accusing UnitedHealth of withholding necessary services to nursing home residents, making their requests for Medicare payments violations of the federal False Claims Act. In 2023, the nurse practitioner dropped the suit after the Department of Justice declined to intervene. His congressional declaration provides new details of his experience.

In a statement, UnitedHealth said Ollivant “lacks both the necessary data and expertise” to assess the effectiveness of its programs. “We stand firmly behind the integrity of our programs, which consistently receive high satisfaction ratings from our members,” it said.

Dubious diagnoses, delayed hospitalizations

UnitedHealth pitches its nursing home initiative as a positive for long-term residents. It provides them access to UnitedHealth nurse practitioners via in-person visits as well as to remote medical professionals who provide guidance to facility nurses at night and on weekends.

This “enhanced care coordination”, as the company puts it, is supposed to help reduce unnecessary hospitalizations, which are costly for UnitedHealth and can expose patients to additional complications.

In several cases identified by the Guardian, the company’s insertion of itself into nursing home emergency protocols helped delay or avert transfers for patients who could have benefited from immediate hospital care.

UnitedHealthcare building in Phoenix, Arizona.

View image in fullscreen

UnitedHealthcare building in Phoenix, Arizona. Composite: Patrick T Fallon/AFP/Getty Images

In one incident from 2019, a remote UnitedHealth medical provider working for the program received a report shortly after midnight about a nursing home resident in Renton, Washington, who was slurring her words and unable to move her arm – textbook stroke symptoms.

In stroke cases, every minute counts. When blood flow to the brain is blocked or interrupted, brain cells quickly die. The sooner patients get to the hospital, the better the chance doctors have to prevent long-term neurological damage.

In this case, the nurse at her nursing home reported to UnitedHealth that it looked like a stroke, according to an incident log. But instead of greenlighting an immediate hospitalization for a possible stroke, the remote UnitedHealth employee suggested the resident might be suffering from a less serious condition called a transient ischemic attack (TIA), a temporary loss of brain function caused by blood flow blockage.

The remote employee then advised the nurse to run a blood test and update the company again in four hours, confidential UnitedHealth records show.

The patient’s independent primary care doctor told the Guardian she was never informed of this failure to transfer her patient.

“I would have wanted them to contact me right away so that I could have made a decision,” she said, speaking on the condition of anonymity to discuss sensitive patient matters. “The time frame matters.”

The independent doctor also said she was disturbed by the remote UnitedHealth employee’s working diagnosis, which called for ruling out a TIA, rather than a stroke. The remote employee was an early-career nurse practitioner, not a physician.

“Their diagnosis says TIA, [but] nobody can say that so early,” the patient’s doctor said.

In another incident that year, a nursing home nurse in Puyallup, Washington, delayed hospitalizing a resident also exhibiting potential stroke symptoms because of UnitedHealth protocols that pushed facility staff to wait for guidance from the company.

According to confidential nursing home records obtained by the Guardian, the nurse phoned a remote UnitedHealth provider, who was unsure about what to do and failed to call for an immediate transfer. Tired of waiting for a callback, the nurse finally bypassed the remote provider and called an independent doctor, who ordered the patient to be transferred.

But the delay meant that about an hour passed before the resident was actually taken to the hospital, which was only a few minutes away from his facility.

After the belated hospitalization, the patient suffered permanent verbal slurring and facial droop on the right side of his face, audio recordings and photos obtained by the Guardian show.

Citing confidentiality rules, UnitedHealth declined to comment on the specific patient cases. But the company noted that it does not prevent nursing homes themselves from contacting residents’ independent doctors, and that hospitalization decisions can depend on many factors including a patient’s goals of care, symptoms and the input of their care team.

UnitedHealth’s pressure on nursing home staff

UnitedHealth denied that its employees prevented hospital transfers and said it was the responsibility of the treating physician and the facility to decide on a patient’s best course of care.

But in practice, the company’s tactics put pressure on facility nurses to turn over patient care decisions to UnitedHealth staffers, according to internal documents and interviews with current and former UnitedHealth medical providers.

“There was never any caveat, given, like, ‘It’s up to you all,’” said one former UnitedHealth doctor involved in the program. Nurses at the long-term care facilities “were calling the nurse practitioner or on-call provider who was responsible. The implication was that they were calling for advice that was meant to be followed.”

“A lot of times the nurses want to send people out and we have to go in and try to stop it,” said another current UnitedHealth nurse practitioner, who also spoke to the Guardian anonymously citing fears of retaliation. “And if we don’t, it’s on us. They take us out on to the carpet.”

In one patient case identified by the Guardian, nursing home staff sent a resident to the hospital because she was found unresponsive, drooling and with a “slant to the side” – possible stroke symptoms. She was admitted to the intensive care unit for a brain bleed, according to a UnitedHealth email reviewed by the Guardian.

But after the incident, instead of praising the facility team for the prompt hospitalization, a UnitedHealth manager alerted her subordinates that the facility team had bypassed the company’s protocol, failing to contact UnitedHealth’s remote on-call team first to receive guidance.

The manager met with the nursing home’s director of nursing services, and scheduled training to re-educate the facility’s nurses, the email shows.

UnitedHealth notes that unnecessary hospitalizations can expose patients to pressure injuries, falls and other complications. In response to questions from the Guardian, UnitedHealth pointed to one 2019 study which heralded the program’s success in reducing hospitalizations and noted the potential harms of hospital care.

But in an interview with the Guardian, Ollivant, the former UnitedHealth nurse practitioner turned whistleblower, argued such analyses fail to account for the negative health outcomes that patients suffer from missing hospital care.

“How many of those people were further harmed because they never received the care that they needed?” he said. “When you just look at the percentage reductions in hospitalizations, it doesn’t say anything about patient outcomes.”

A plan of care, an ailing patient

Kevin Keep never knew – until the Guardian called him last month and told him – that his father had suffered a possible stroke at a nursing home that partnered with UnitedHealth.

On the evening of 23 February 2019, a UnitedHealth remote employee received a report about Keep’s father, Donald Keep, a retired auto mechanic with dementia and an amputated leg living at a nursing home in Bremerton, Washington.

man on his wedding day

View image in fullscreen

Donald Keep on his wedding day. Photograph: Kevin Keep

On that day, Keep was experiencing forgetfulness and drooping on the right side of his face – “possible stroke symptoms”, according to a confidential UnitedHealth incident log.

But instead of sending the octogenarian straight to the hospital, the remote employee referred to a plan of care that called for bloodwork and giving Keep an aspirin – a course of action which one former UnitedHealth doctor said “doesn’t make sense”, given the risk of brain damage.

“That’s not useful when it might be a stroke,” said the doctor, who spoke on the condition of anonymity to comment on Keep’s confidential patient records that he reviewed at the request of the Guardian. “What they really need is a physical exam and an MRI of the brain, and it needs to be done expeditiously.”

The incident log, which doesn’t mention a hospital transfer, suggests that the UnitedHealth team didn’t treat the case with the urgency that a possible stroke would require.

Keep’s symptoms were logged shortly before 10pm on a Saturday night. The next afternoon, a UnitedHealth employee emailed the company’s nurse practitioners a follow-up note to look into what was wrong with Keep.

The email lists the proposed work-up as being for a “TIA” – the transient, less serious neurological condition, not a stroke.

As of 4pm on that Sunday, more than 18 hours after Keep was found with his face drooping, the work-up was still listed as “pending”.

Citing patient confidentiality, UnitedHealth did not respond to an inquiry about whether the retiree was ever sent to the hospital.

Hannah Recht contributed data reporting

Tomorrow, part two of UnitedHealth investigation: A tale of three whistleblowers

UnitedHealth’s Revenues Rise, in First Earnings Report Since C.E.O.’s Killing

Revenues for UnitedHealth Group amounted to $100.8 billion for the fourth quarter

But high medical costs contributed to results that disappointed Wall Street, and the company’s stock fell on the news that it had made less than analysts expected.

https://www.nytimes.com/2025/01/16/health/unitedhealth-earnings-report-ceo-murder.html?searchResultPosition=1

An exterior view of a building, with a large white sign in the foreground that reads "UnitedHealthcare."

UnitedHealth Group’s campus in Minnetonka, Minn. Earnings reported Thursday were the company’s first since its chief executive was killed.Credit...Jim Mone/Associated Press

Danielle Kaye.png

By Danielle Kaye

Jan. 16, 2025

UnitedHealth Group reported on Thursday that it earned less than expected this past quarter, citing higher medical costs and pressure on its insurance division at a time when the company is still reeling from the shocking murder of a top executive last month.

Revenues for UnitedHealth Group amounted to $100.8 billion for the fourth quarter, below what analysts had predicted but still 6.8 percent higher than in the same quarter the year before. The company’s full-year revenue for 2024 rose to $400.3 billion. For UnitedHealthcare, the insurance division, full-year revenue increased to $298.2 billion, up 6 percent from 2023.

The results were the company’s first since Brian Thompson, the chief executive of UnitedHealthcare, was gunned down in front of a Midtown Manhattan hotel.

The murder unleashed public outrage aimed at big health insurers, over lack of access to health care and denials of coverage and insurance claims.

Some shareholders have urged UnitedHealth to issue a report on its practices that “limit or delay access to health care.”

Andrew Witty, UnitedHealth Group’s chief executive, said on a call with analysts on Thursday that frustrations about claims, including delays in receiving care and coverage, were “key areas for us to work hard at to improve.”

A successor to Mr. Thompson has not been named yet. Mr. Witty did not share details about filling the post, nor did he directly address the recent shareholder campaign.

But he and other executives discussed the loss of Mr. Thompson at the top of the call.

“He devoted his time to helping make the health system work better for all of the people we’re privileged to serve,” Mr. Witty said.

UnitedHealth’s results, which disappointed Wall Street, in many ways reflected broader trends and lingering issues for the industry. For several quarters, U.S. health insurers have taken hits to their earnings from high medical expenses and a tightening of government payment policies.

John Rex, the company’s chief financial officer, pointed to cutbacks in government rates in the payment system for Medicare Advantage program, the private insurance arm of the federal coverage for people 65 and over. UnitedHealth has substantial business in these Medicare private plans.

Medicare Advantage performance has declined throughout the industry recently, partly because of regulatory changes meant to prevent overcharging and following increased health spending among some older populations.

Mr. Witty also said there were costs associated with changes in Medicaid, the federal-state insurance program for the poor.

The company’s medical cost ratio, a measure of the cost of providing care, came in higher than expected in the most recent quarter, which could add fuel to investors’ concerns that increased costs for delivery of care might linger, said John Boylan, an analyst at Edward Jones, an investment firm.

UnitedHealth, however, kept its full-year guidance for 2025 intact, unaltered by recent pressure. Analysts at Morgan Stanley said in a research note that the company had set “reasonably prudent targets” for this year.

“Overall, our view is that United is well positioned to navigate the evolving health care landscape due to its diversified business model,” Mr. Boylan said.

UnitedHealth’s stock fell 6 percent on Thursday as investors digested the weaker-than-expected results. UnitedHealth’s results, often seen as a bellwether for performance across the industry, pushed down shares of its rivals, including CVS Health, which is the parent of the insurer Aetna.

UnitedHealth Group also owns Optum Rx, one of the country’s largest pharmacy benefit managers, which employers and government programs hire to oversee their prescription-drug benefits.

Optum Rx has faced scrutiny from regulators over concerns that it has raised drug prices, prioritizing its own interests above those of patients, employers and taxpayers. Just this week, the Federal Trade Commission released a report detailing how P.B.M.s could be inflating drug costs.

The agency criticized Optum Rx and two other major benefit managers — CVS Health’s Caremark and Cigna’s Express Scripts — for raising prices on generic drugs for cancer, heart disease and other illnesses as high as 1,000 percent of national average costs.

Mr. Witty, the UnitedHealth Group chief executive, defended Optum’s practices, stressing that 98 percent of the rebates were passed to customers. By 2028, he said, all rebates would be passed on. Drug prices in the United States, Mr. Witty argued, are “de novo set too high relative to any other price in the world,” and shifted the blame to drug companies.

“The P.B.M. acts on behalf of the ultimate payer — the employer, the union, the state,” Mr. Witty told analysts.

Mr. Witty did not address investigations by the Justice Department or lawsuits seeking to block its proposed acquisition of Amedsys, a large home care and hospice company.

Beyond rising medical costs and increasing use of health care services, UnitedHealth executives pointed to the widespread ransomware attack in 2024 that weighed on the company’s full-year profits. The cyberattack forced the shutdown of the company’s sprawling billing and payment system, Change Healthcare. The company has estimated that the data breach of health and privacy information affected more than 100 million people, and said this week that a review of personal information involved in the incident was “substantially complete.”

Luigi Mangione, 26, has been charged with multiple state and federal counts of murder as well as weapons and stalking offenses. He has pleaded not guilty.

UnitedHealth and the police have said that neither he nor his parents had medical insurance through UnitedHealth.

For more information:

https://nationalsinglepayer.com

Added to the calendar on Sat, Jul 12, 2025 8:24AM

Add Your Comments

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network