Who Rules Oakland?

Part 1., Corporate Directors and the Oakland Metropolitan Chamber of Commerce

By Darwin BondGraham and Adrian Drummond-Cole

[Download a pdf of this report for higher resolution images, print format, and notes.]

The Oakland Metropolitan Chamber of Commerce is a non-profit "business league" organization, chartered under Section 501 (c) 6 of the IRS Code. According to the IRS, business leagues are not organized for profit, and no earnings may directly benefit their members. However, business leagues can lobby government leaders for laws and policies in the interest of their members, and they can also engage in political campaigning for and against candidates and specific ballot initiatives. These are, in fact, the main reasons business leagues are chartered, and in this sense, chambers of commerce and similar groups are entirely about profit.

The goal of a business league is to promote political conditions in which their members can obtain lucrative government contracts, avoid local and state taxes, pass off operating expenses onto the public, and privatize public goods. Chambers of Commerce are essentially political committees of regional business leadership organized to secure favorable laws and regulations. They further serve as public relations fronts for big business, publishing propaganda, organizing promotional events, and serving as advocates for the "business community" to the media.

The membership of most chambers of commerce is split between two kinds of businesses. The first group is comprised of smaller companies, usually based in the same city as the chamber, and usually dealing in some kind of product that depends on the local business climate think tourism, entertainment, conventions, food, sports, and real estate, among other things. The second category is comprised of larger corporations with national and transnational operations. Often though, these larger corporations have significant enough investments in a particular place to make participation in a local chamber strategically useful.

Large banks are a good example of this latter category of members in that they frequently participate in local chambers to promote local branches and ensure access to local housing, consumer, and business lending markets. Mining and manufacturing corporations are also frequent participants in local chambers of commerce. The business practices of these corporations often have negative environmental and social impacts on communities, so they utilize the public relations functions of local chambers to influence public opinion.

Another key reason why large corporations and smaller companies form business leagues is to build business networks. The concept of "networking" is so ubiquitous today that it's almost unnecessary to explain. But in the business world, networking specifically refers to the establishment of professional and social ties that advance mutual power aspirations. Business executives participate in chambers of commerce to network with their peers, building the relationships and creating the cultural cohesion that sustains and enriches their rule.

In the Oakland Metropolitan Chamber of Commerce, these two groups local smaller business owners and representatives of larger corporations overlap to some extent. It is the larger corporations, however, which hold the most power in the Chamber. Large corporations find membership in the Oakland Chamber of Commerce to their advantage because Oakland is a major consumer market, a major port of entry for goods into the United States, and headquarters to both regional government offices and peer corporations with multi-million, and in some cases, billion dollar revenues.

The following analysis is concerned with these major corporations and their membership in the Oakland Chamber of Commerce. In this report we focus on the networks created by directors of the Clorox Company and PG&E to illustrate linkages that are applicable to large corporate members of the Chamber more broadly.

Most of these companies have large dollar stakes in the Bay Area and California markets. Their membership and control of the Oakland Chamber of Commerce is just one small part of multifarious political operations intended to influence lawmakers and regulators across numerous local and state governments. This, in turn, is part of a larger national network of business lobbies and think tanks focused on the federal government and international institutions.

Finally, although space limitations here prohibit it, at the end of this report we are including a brief analysis of the other sixteen major corporations currently represented by board members on the Oakland Chamber of Commerce. Investigation into the power wielded by their directors and owners awaits further study.

Corporate Networks

How do these different corporations come to agree on a shared political program to pursue through the Oakland Chamber of Commerce? At first this would seem very difficult, as some of these companies have drastically different legal and regulatory concerns, and some are in fact competitors.

If we look at the directors and major shareholders of these companies, however, a picture of cohesive networked governance emerges. Yes, some of these companies compete with one another, and many have differing legal and regulatory concerns, but there is much overlap in both ownership and management of these companies. The following information pertains to their mutual direction and ownership by powerful board members and the private equity groups some of them represent.

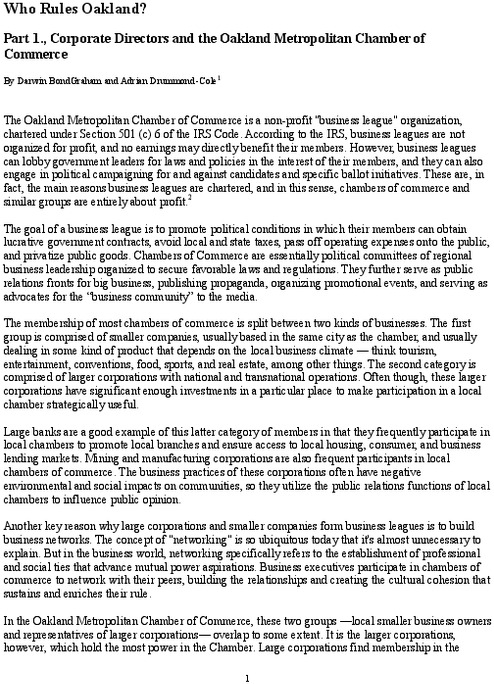

Figure 1 illustrates the core network of corporate power embodied in the Oakland Chamber of Commerce. Five board members of the Chamber in this network, identified as large circular red nodes, represent the interests of five major corporations that fund the Chamber. These five corporations have the most reciprocal ties to other companies in the entire network represented in our data set.

1. Micky Randhawa - Wells Fargo

2. Victoria Jones - Clorox

3. Nathan Nayman - VISA

4. Alicia Bert - PG&E

5. George Granger - AT&T

|

Figure 1., Core Corporate Network Represented Through the Oakland Chamber of Commerce: Red square node positioned at center represents OMCC board. Five large red circular nodes represent select OMCC board members. Black square nodes represent corporate entities. Small red nodes represent directors or senior executives of select corporations with OMCC membership. Selections determined by deleting pendants, leaving only directors with more than one link to the network's core corporate entities. |

If we explore the network of governance and ownership through persons linked to each of these companies, we find that often, through only one or two degrees of separation, these corporations are linked back to each other in a web of mutual governance. They share some of the same directors on their boards, and some of their directors are linked to each other by third-party corporations which they also control. This is often, but not always, due to concentrated ownership of voting shares across many corporations by powerful private equity funds (i.e. hedge funds, private equity groups, investment banks, etc.). Owning large shares of each company, a powerful investment firm uses its shares to appoint its own directors to each corporate board. When this structure of ownership is viewed from a distance, we can see how powerful corporations in seemingly divergent industries are often owned by, and ultimately governed by, the same wealthy elites.

Let's zoom closer in. Micky Randhawa represents the regional interests of Wells Fargo Bank on the Oakland Chamber of Commerce's board of directors, but Wells Fargo's board members are interested in more than just their company's fortunes. Among Wells Fargo's directors is John Chen, chairman and CEO of Sybase, Inc., a computer software company. Chen was a director of Pyramid Technology Corporation, a manufacturer of server hardware, and later worked for Siemens after the German company bought Pyramid in 1995. Incidentally, Chen is also a director of the Walt Disney Company and a former board member of the US Chamber of Commerce.

Chen is not just a director. He is a significant owner of both Disney and Wells Fargo stock. His ownership of shares in these companies is a result of his compensation as a board member. He and his peers, who together own a large share of these companies, ultimately determine the strategic goals of both.

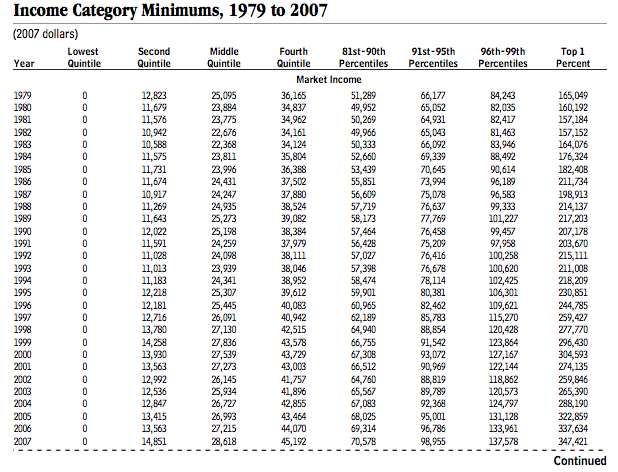

Chen's income in 2010 as a shareholder and director of Wells Fargo and Diseny totals $505,438. Although this is by no means his sole source of income, and only a small fraction of his total net worth, this sum alone puts him in the top 1% of America's income distribution. (At the end we have attached a detailed breakdown of income distribution in the US between 1979 and 2009 in order to demystify the so-called 1%, and provide benchmarks for understanding inequality in relation to the fortunes of those discussed here.)

Alongside Chen on the board of Walt Disney Co. is Robert Matschullat. Matschullat is a board member of Clorox and VISA, both companies with direct representation on the Oakland Chamber of Commerce board.

The Clorox company is linked back to Wells Fargo by route of other directors who also sit on the board of the San Francisco headquartered McKesson Corporation, the world's largest distributor of health care systems, medical supplies, and pharmaceuticals. These links can be confusing, but by referring back to Figure 1, we can visualize them and see how this creates a cohesive network of corporate governance and ownership.

McKesson, Disney, and Sybase (a subsidiary of the giant German software company SAP AG) are all governed by directors who in turn sit on dozens of other corporate boards, but this data has been omitted from Figure 1 to keep the diagram as simple and intelligible as possible, and also to only illustrate directors who create a cohesive network of governance among the five corporations which partly control the Oakland Chamber of Commerce.

If, however, we were to map these extended linkages, we would discern an ever expanding and relatively cohesive network of corporate ownership and governance, and we would find that these other corporations cooperate with one another to operate business leagues in other cities in the United States and beyond. For example, Kim Delevett, Corporate Community Affairs Manager for Southwest Airlines, sits on the board of both the Oakland Chamber of Commerce and the San Jose Silicon Valley Chamber of Commerce. Similarly, Ken Maxey, Regional Government Affairs Manager for Comcast, sits on the boards of the Oakland Chamber and the Livermore Chamber.

Although Figure 1 does not show these extended linkages to other corporations and business leagues, here are a few more examples we could map if we were to plug in the data: McKesson's Chief Financial Officer is a board member of the San Francisco Chamber of Commerce. Disney has placed executives on the boards of many business leagues including the Florida Chamber of Commerce and Los Angeles Chamber of Commerce. SAP AG's current CEO is a past member of the US Chamber of Commerce.

Other corporate links in Figure 1 are worth exploring in detail, so let's take a look at the networks of two companies which fund and steer the Oakland Chamber of Commerce: the Clorox Company and Pacific Gas & Electric.

The Clorox Company

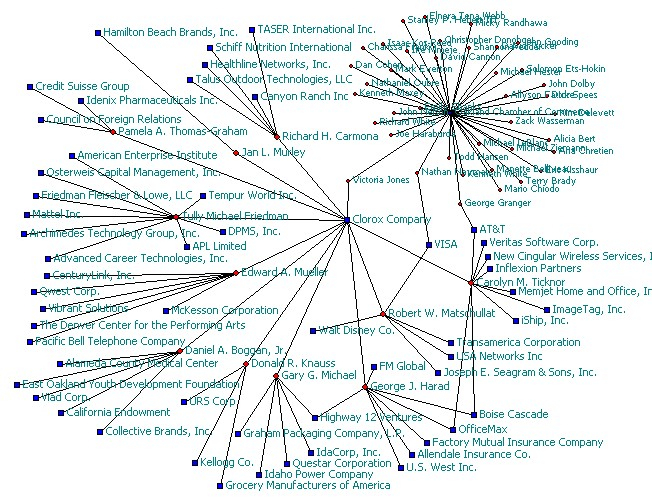

The Clorox Company, headquartered in Oakland, is a multi-billion dollar business with manufacturing facilities in nineteen countries worldwide. While Clorox is most commonly associated with liquid bleach, they also own twenty brands including Brita, Glad, Hidden Valley, Scoop Away, K C Masterpiece, Pine-Sol, and Burt's Bees. Figure 2 is a network diagram emphasizing the Clorox Company's links to other corporations through its board of directors.

|

Figure 2., Clorox's Core Corporate Network in Relation to the OMCC: Blue square dots represent corporate entities. Red circular dots represent directors or senior executive officers. Egonets for all corporations besides Clorox have been deleted to reduce clutter and emphasize only ties connecting Clorox directors and OMCC directors. OMCC board appears as dense cluster in upper right. |

The first thing you will probably notice is that two of Clorox's directors also sit on the boards of VISA and AT&T, corporations that also fund and steer the Oakland Chamber of Commerce through their representatives on that board.

Robert Matschullat, mentioned above, is a director of VISA. Besides Disney, Matschullat is also a director of the Transamerica Corp., USA Networks, and Joseph Seagram & Sons.

Transamerica is an insurance corporation owned by AEGON, a Dutch company. It's office tower in San Francisco is internationally famous for its pyramid shape.

USA Networks is a television company owned by NBCUniversal.

Joseph Seagram & Sons was originally an alcohol distiller based in Canada, but it became a conglomerate in the 1980s by acquiring large ownership stakes in other companies, including DuPont. When it sold its DuPont shares in the mid-1990s Seagram's, under Matschullat's leadership, bought into media and entertainment companies like Universal Studios (now part of NBCUniversal see the links and how they develop across time as companies are bought, merged, and sold?).

That Matschullat is a board member of USA Networks, now owned by NBCUniversal, and Seagrams, which used to own Universal, is obviously no coincidence. Matschulatt was a key figure in shuffling the organization of ownership and direction of these companies. Not coincidentally, Matschullat also used to be a director of the McKesson Corporation.

Clorox board members Carolyn Ticknor and George Harad are linked to one another through their past positions as a director and as CEO (respectively) of Boise Cascade, which briefly owned OfficeMax until the latter was spun off in 2004 in a highly complex corporate restructuring driven by Chicago financiers. Ticknor is also a member of AT&T, which is a corporate member of the Oakland Chamber of Commerce.

All in all, the board members of Clorox are shareholder in, or independent directors of, many additional powerful corporations and private equity groups.

Clorox director, Edward Miller, is a board member of the seemingly ubiquitous McKesson Corp.

Clorox director Donald Knauss is a director of the global construction and engineering giant URS which has innumerable major military contracts and co-manages the two US nuclear weapons labs at Los Alamos, New Mexico, and Livermore, California in limited liability partnerships that include Bechtel and the University of California.

Clorox director Tully Friedman was a board member of APL Limited, a shipping corporation that uses the port of Oakland's facilities. We'll return to APL in a moment, but first let's look more closely at Friedman.

Tully Friedman is a current and past board member of numerous other corporations that his San Francisco investment firm, Friedman Fleischer & Lowe, LLC, has bought equity stakes in. The multi-billion dollar pots of money that Friedman oversees include contributions from very wealthy individuals, many of whom sit on the boards of companies already discussed above, or who had past executive positions at these very companies.

For example, Robert Matschullat, the presiding director of the Clorox Company mentioned above, has invested part of his personal fortune in Friedman's firm. The retired chairman and CEO of Clorox, G. Craig Sullivan, is also an investor in Friedman Fleischer & Lowe, LLC. A retired CEO of McKesson, a retired chairman of Wells Fargo, and a current director of AEGON (parent company of Transamerica) are all investors in Friedman's capital fund.

Like many finance capitalists, Friedman is involved in steering national non-profit corporate advocacy groups. He is a director of the ultra-conservative American Enterprise Institute; a think tank that promotes political reforms that would further empower corporations and the wealthy.

Now quickly back to APL. Beginning as a state-owned US shipping company, APL was privatized after World War II. In 1997 it was sold to Singapore-based NOL Lines for $825 million, or $33.50 per share. Alongside Tully Friedman on the board of APL Limited were Frederick Hellman and Barry Williams.

In 1984, Frederick Hellman and Tully Friedman co-founded Hellman & Friedman LLC, another private equity firm. Although Friedman left the firm in 1998 to start his own equity group, he reportedly maintains a collegial relationship with Hellman, perhaps best symbolized by the fact that Hellman didn't drop Friedman's name from the company's moniker. Today both firms are headquartered in the same building, One Maritime Plaza in San Francisco. When APL was sold to NOL Lines Friedman and Hellman each owned more than 2 million shares.

Hellman is as blue-blooded as Californians come. He is the great grandson of financier Isaias Hellman who, among other things, created Wells Fargo Bank and occupied a seat on the UC Board of Regents for the better part of four decades. Isaias Hellman's son and grandson served as presidents of Wells Fargo, among other roles. The Hellman family's history is deeply intertwined with Wells Fargo and the UC, which are further linked together in a web of financial and political connections that deserves its own detailed analysis.

Former APL director Barry Williams is not depicted in Figure 2, but he is strongly connected to the Oakland Chamber of Commerce. Moving on to Figure 3, we will further investigate the corporate networks of power that steer the Chamber, starting with Williams.

PG&E

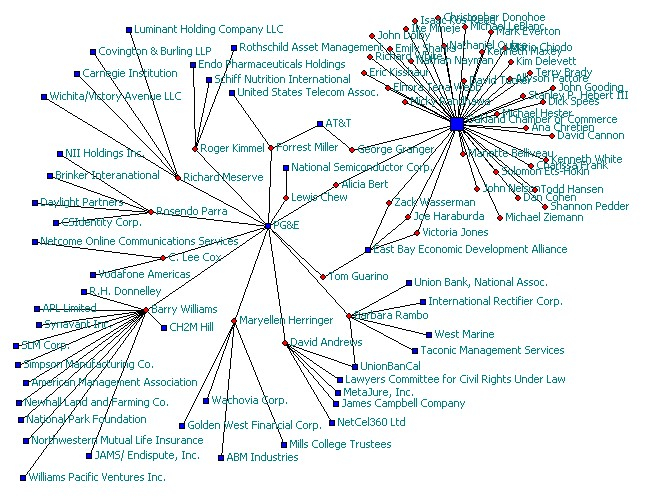

The network of Pacific Gas and Electric, an Oakland Chamber of Commerce corporate member, is depicted in Figure 3. Barry Williams sits on PG&E's board of directors. In addition to his seat on APL's board, Williams is a director of numerous other companies, including the Colorado-headquartered environmental engineering giant CH2M Hill, which has a major regional office in Oakland. Refer back to Figure 1 to visualize how Williams occupies power within the corporate network that steers the Oakland Chamber.

|

Figure 3., PG&E's Core Corporate Network in Relation to the OMCC: Blue square dots represent corporate entities. Red circular dots represent directors or senior executive officers. Egonets for all corporations besides PG&E have been deleted to reduce clutter and emphasize only ties connecting PG&E directors and OMCC directors. OMCC board appears as dense cluster in upper right. |

Like Clorox, many of PG&E's board members are the owners and directors of a vast array of other major corporations. Of particular interest in terms of the cohesive network of corporate governance underlying the Oakland Chamber of Commerce is Forrest Miller. Mr. Miller is a director of PG&E, having been elected in 2008. He is also a senior executive of AT&T.

At AT&T, Miller is responsible for "corporate strategy and development." This title refers to a school of business management thinking developed over the last several decades which emphasizes the ways that companies can systematically analyze their strengths and weaknesses in their "operating environment." The "environment" here is conceived of largely as the laws and regulations affecting a corporation's behavior, but can also mean industrial competitors and external forces like broader changes in consumer preferences or the availability of resources, labor, and other inputs.

In practice, only half of "corporate strategy and development" is about making "internal" changes to a company in response to "external" factors. The other half involves changing the "external environment." In this respect, Mr. Miller's job entails strategizing ways that AT&T can increase its power and profits by altering existing laws and regulations, eliminating potential competitors through mergers and acquisitions, preventing competition by maintaining current telecommunications laws and policies, and gaining entry to new markets controlled by foreign states. This is why Miller is a past director of the US Telecom Association, a 501 (c) 6 business league that is organized to promote the interests of its membership, large telecommunications companies (AT&T, Verizon, etc.). US Telecom is one of the largest lobbyists in Washington D.C., spending millions each year to influence lawmakers and regulators in Congress, the White House, Federal Communications Commission, and Federal Trade Commission.

To be fair to Forrest Miller, his job, notwithstanding its elaborate title, is not particularly different from that of nearly every other corporate director or executive at PG&E, or any of the other corporate directors discussed so far. They are all intensely focused on influencing lawmakers, packing bills with beneficial provisions for their firms, shaping regulations to strengthen their control of markets, and undermining environmental and labor policies.

Who Rules?

In subsequent parts to this series, we will present more network data illustrating the Oakland Chamber of Commerce's member companies. We will also give more detailed information about the directors and executives of these companies, and provide an analysis of their social cohesion, profit-driven collusion, and political influence. More broadly, we will explore networks and institutions of economic and political power in the Bay Area. Below, however, is a brief explanatory list of the current corporations with representatives on the Oakland Metropolitan Chamber of Commerce:

1. Clear Channel Outdoor, an advertising company owning and operating billboards and other outdoor display faces, currently valued at $3.7 billion. Clear Channel owns and operates numerous billboards, bus shelter ads, and other display faces on both private and publicly owned properties in the Bay Area.2. Swinerton, a private construction company based in San Francisco, builds for developers, government, and corporate clients. Swinerton projects in Oakland include the Ice Center, the twenty-story Essex tower on Lake Merritt, the twelve story Ellington Condominiums, and the famous "comic book" retrofit of the Oakland Police Headquarters. Outside of Oakland Swinerton has built casinos, military installations, and headquarters for companies like The Gap, Inc.

3. Pankow Builders, similar to Swinerton in scope, is a major construction company headquartered in Pasadena with a regional office in Oakland. Pankow built the Whole Foods in Oakland.

4. The global communications giant AT&T is valued at $162 billion. It has numerous operations in the Bay Area. AT&T's economic reach and political influence are too expansive to detail here.

5. PG&E, the region's behemoth investor owned utility, operates gas and nuclear fired power plants in California, and owns much of the state's electricity and gas distribution grid and pipeline infrastructure. Headquartered in San Francisco, PG&E is valued at $15 billion. Its profit margin is highly dependent on California state laws and regulations. Thus PG&E fields an army of lobbyists across all levels of government.

6. Securitas is a Swedish private policing company that hires out security personnel, including guards and investigators, to secure corporate property, wealthy residential associations, and high net worth individuals, among other glittery things. Securitas has a regional office in East Oakland, and is valued at $21 billion.

7. Southwest Airlines operates in the United States and is headquartered in Dallas, Texas. It is valued at $5.8 billion. The Oakland Airport is a major hub.

8. Grubb & Ellis buys, owns, and sells real estate. The company leases out several hundred thousand square feet of office space in downtown Oakland, much of this right along Broadway between 20th and 15th Streets. The company's business model is predicated on increasing land values in Oakland and other cities. Grubb & Ellis is headquartered in Orange County and valued at $21 billion.

9. CIM Group is another real estate corporation, specializing in ownership and management. It's headquarters are in Los Angeles. It's regional Bay Area office is at 1333 Broadway in the 1 Kaiser Plaza building, a 28-story office tower the company owns and manages. CIM Group owns over 1 million square feet of office and hotel real estate in downtown Oakland. The company's business model is predicated on increasing land values in Oakland and other cities.

10. Colliers International is yet another real estate company that brokers much square footage in Oakland, especially downtown on Broadway, Harrison, and Franklin Streets. Colliers leases out office space in the Wells Fargo Bank Center building on Harrison, among other corporate properties. The company's business model is predicated on increasing land values in Oakland and other cities.

11. Sunwest Bank is a business bank headquartered in Tustin, a city in Orange County, California. It's Oakland office is at 1999 Harrison in the Lake Merritt Plaza.

12. Summit Bank is an Oakland-based, privately owned bank with assets between $100 million and $3 billion.

13. Waste Management transports and disposes of residential, industrial, healthcare, and construction wastes. The company has an Alameda regional office and contracts with the city of Oakland and other regional governments to haul trash. Headquartered in Houston, Texas, Waste Management is valued at $14 billion.

14. Clorox, a consumer products company, is the largest corporation headquartered in Oakland with a market value of $8.4 billion. Located one block from Oscar Grant Plaza, the corporation's executives have long been involved in Oakland and the East Bay's politics, even though the legislative and regulatory issues the company is most focused on are federal.

15. Comcast, another telecommunications giant valued at $57 billion, specializes in cable. It counts the Bay Area among its largest markets. It's economic reach and political influence are too expansive to detail here.

16. VISA is headquartered in San Francisco on Market Street. The credit card company's entire business model is predicated on helping banks and other lenders intensify consumer debt. Visa is worth $61 billion. It's main corporate campus is in Foster City in San Mateo County.

17. Bank of America was headquartered in San Francisco until 1998 when it merged with NationsBank. The company, valued at $52.4 billion, counts California and the Bay Area among its biggest consumer and home loan markets. Bank of America absorbed Merrill Lynch during the financial crisis in 2009 and now operates Merrill as its investment bank subsidiary.

18. Wells Fargo is still headquartered in San Francisco. Valued at $123 billion, it counts California and the Bay Area among it biggest consumer and home loan markets. Wells Fargo absorbed Wachovia during the financial crisis in 2009, and retired the Wachovia brand in October, 2011.

|

Source: Congressional Budget Office. "Trends in the Distribution of Household Income Between 1979 and 2007." October, 2011. http://www.cbo.gov/ftpdocs/124xx/.../10-25-HouseholdIncome.pdf |

My other concern is that the vision of Occupy Oakland and Occupy Elsewhere is stuck in the same old rut that finds someone(s) to cast in the role of enemy and attributes all of their woes to them. For example, all that good research and all those thousands of words are based on and motivated by a flawed fundamental assumption that "the Oakland Chamber of Commerce and other business lobbies in the East Bay have recently pressured government officials to crack down on Occupy Oakland." Given that you are addressing a sympathetic audience, I would rather see something that brings into question our position rather than reinforcing that boring, self-righteous, short-sighted entrenchment in polarization that characterizes so much of the rhetoric and propaganda coming from the People's media.

All things exist in balance, so I want to look at the ways in which government officials have pressured the Chamber of Commerce and other business lobbies. And on a higher level of analysis, I'd like a compassionate exploration of what pressures might be in play on the government officials and the business community that are pressuring the 99%. "We! Are! the 99%!" works well as a rallying chant, but when you dehumanize and demonize the 1% by writing off their actions as examples of "corporate greed," you are ignoring the truth of those systemic pressures that THEY are under. You are subject to the same naivete as the Obamaniacs who are so angry and distraught because of broken campaign promises. Is it because Obama is weak, evil, fickle, or flawed in some other way? Or are we willing to take an unbiased look at the political and economic pressures that are established by the constitution and the rule of law and brought to bear on ANY president? Are we even willing to entertain the possibility that it is the system of "checks and balances" that is flawed?

I think we are not. I think most of the 99% are still in the thrall of the American Nightmare where everyone must have a job, house, car, spouse, 2.3 children, and enough consumer crap to be deemed a success by others and therefore have a life worth living - all on the backs of the rest of the world. Not until the 99% are willing to do the sober self-examination of the extent to which we all perpetuate our own oppression will we be able to rise above it as a movement.

And "government officials" doesn't work for me anyway. Are we still harping about excessive use of force by municipal police departments? As tragic and harmful as the outcome has been, I am much more concerned about the threat of military retaliation for the "terrorist threat" of shutting down the shipping industry than I am about winning the hearts and minds of the armed homeboys (including the homeboys who are female). I'm not saying don't do it. I just really want my comrades, my children, my grandchildren to have a realistic picture of what they're inviting with their 20th century tactics, their insistence on being "right" and having "rights." Of course we're not terrorists (and we used to have the right to free speech until we gave it up after 9/11), but crippling shipping for a day won't convince the US Senate and the Pentagon of that!

President Shrub was correct when he said that the constitution is just a piece of paper, and instead of seeking the truth behind that offensive statement and exploring why the constitution has degraded into impotence, we rush to protest the statement and the person who made it. It's meaningless to protest injustice and accountability (as we see it). We all want those things, even those we would subject to the very same oppressive retaliation and punishment to which we are subjected when those in power demand accountability and justice (as they see it) of us. A two-year-old with shit in his britches is "right" when they protest their discomfort, but it doesn't fix the problem unless they have a caregiver whose needs are also served by "redressing the grievance."

The War of Love will not be without casualties. We're not all going to make it. And it won't be we passive, unfit, unskilled, oil-and-plastic-addicted westerners who will survive. It will be those who own nothing and nevertheless contribute to the resilience of their communities and know how to find fulfillment on less than $5 income, not we who think we are responsible for changing that. Do we really believe in people before profits? I don't think so!

Respectfully, many of us disagree profoundly with your comments.

First of all you are factually incorrect on several issues.

1. Contrary to what you think, the Oakland Chamber of Commerce has pressured local government officials to get rid of the Occupy Oakland presence downtown, as have other business lobbies. Want proof? Here: http://www.californiareport.org/archive/R201111040850/a; http://blog.sfgate.com/abraham/2011/11/07/oakland-news-mayors-office-plans-to-move-occupy-oakland/; http://hyphenatedrepublic.wordpress.com/2011/11/08/businesses-and-protesters-occupy-a-new-oakland-downtown/; http://www.bizjournals.com/sanfrancisco/print-edition/2011/11/25/moving-ahead-in-oakland-post-occupy.html; and many more sources could be linked to. It's good to read and incorporate facts into your views.

2. The report here that you're commenting on never uses the word "enemy," or the phrase "corporate greed." You're introducing these words here. You shouldn't mis-characterize what others say by putting words in quotes.

3. You state that "all things exist in balance." Sorry, but this is your ontological theory, not a fact. This kind of thinking might lend itself to metaphysical ruminations on the universe or the ultimate meaning of life, but it's not particularly illuminating when trying to understand power relations and the current American political system. What this report is building off of is a very, very widely shared observation that in fact American politics is wildly out of balance, and that corporations and the wealthy have amassed enormous strength and riches relative to the majority. Inequality is by its very definition a lack of balance. See the last chart in the above report and extrapolate from there.

4. You state that you "want to look at the ways in which government officials have pressured the Chamber of Commerce and other business lobbies." That's nice. But empirically it's hard to "look at" something that isn't happening. Think about how power operates in our society. How are politicians elected? Who funds campaigns? Who has the resources to influence the political parties and candidates? Who has the resources to lobby? Who is lobbying? Look at how power flows and you'll realize that corporations and the wealthy are hegemonic today in the political system. Pressure is flowing overwhelming in specific directions. Again, the problem is lack of the balance you wish there to be.

5. You ask, "Are we still harping about excessive use of force by municipal police departments?" and then you go on to make some very strange comments about "homeboys," and so forth. It's hard to respond to you because, based on what appears here, and knowing nothing else about you, you seem so out of touch with the issue of policing, police brutality, and the mass incarceration of people of color. All I can say is, yes, we should all be interested in incorporating an anti-racist analysis of the police state. Although it's not done in this paper, it is clearly a very important core part of any movement for justice today.

Your last three paragraphs are somewhat hard to decipher and tending toward the mystical. What on earth is a "War of Love"?

But does controlling the Chamber of Commerce mean strongly influencing the city, state, and/or federal legislators? I'm sure the answer is yes but I need ammo. What I look forward to seeing now are summaries like this one explaining factual evidence showing how not only the Oakland Chamber of Commerce but Chambers of Commerce in general successfully influence the city, state, and federal legislators. Is it possible to show how Chamber of Commerce A caused Legislator B to vote as he/she did? When I see this evidence, which I'm sure is there and is hopefully easy for individuals like yourself to put together, I will confidently be able to contribute to OWS by stepping up and sharing with my Facebook "Friends" and others in my circle the factual dotted line from Corp. A to Chamber B to Legislator C to their vote on House Resolution D. I do believe the 1% control the legislators but I must rely on individuals like you to bring the to the surface the factual evidence. Once I have this I'm more than ready to use it.

Keep up your informing us. Thanks.

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.