From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

SFLC Labor Supported Prop C Attacks Low Paid City Workers-SF Billionaires&Union Tops

What Jeff Adachi and Interim Mayor Ed Lee Aren’t Telling Voters:

San Francisco Pension Reform Protects Top Earners,

Punishes Over Half of City Employees!

StraightFacts from Employees and Fixed-Income Retirees Whom Adachi, the Mayor,

Their Billionaire Backers, and the San Francisco Labor Council Refused to Meet With

Management Salaries Gobble Pensions

Billionaires Set Six-Figure City Pension Caps

San Francisco Pension Reform Protects Top Earners,

Punishes Over Half of City Employees!

StraightFacts from Employees and Fixed-Income Retirees Whom Adachi, the Mayor,

Their Billionaire Backers, and the San Francisco Labor Council Refused to Meet With

Management Salaries Gobble Pensions

Billionaires Set Six-Figure City Pension Caps

What Jeff Adachi and Interim Mayor Ed Lee Aren’t Telling Voters:

San Francisco Pension Reform Protects Top Earners,

Punishes Over Half of City Employees!

StraightFacts from Employees and Fixed-Income Retirees Whom Adachi, the Mayor,

Their Billionaire Backers, and the San Francisco Labor Council Refused to Meet With

Management Salaries Gobble Pensions

Billionaires Set Six-Figure City Pension Caps

Vote “No” on Prop. C and Prop. D! Salary Reform Must Come First!

The big lie from City Hall is

the claim that the City’s 27,000

employees average $93,000 in

salaries, driving up pensions.

That’s simply untrue. There

were 36,644 employees in

2010, including full- and part-

time employees; the City

Controller converts over

10,000 part-time employees

into “full-time equivalents.”

Of the 36,644 City employees

in calendar year 2010, 18,972

(52%) earned less than

$70,000, representing $665.7

million (25.6%) of payroll.

Their average total salaries

were just $35,091.

In stark contrast, the 11,838

employees (32.3%) earning

over $90,000 gobbled fully

$1.47 billion (56.5%) of

payroll. Their average total

salaries were $123,874!

Skyrocketing management

salaries since 2003 inflate

management pensions. These

inverted ratios disproportion-

ately penalize 52% of lower-

paid employees.

In 2003, there were 2,918

City employees earning over

$90,000 in total pay, costing

$314 million. In 2010, the

City’s 11,838 employees

earning over $90,000 is an

increase of 8,920 such highly-

paid employees, a staggering

305.7 percent change since

calendar year 2003!

Clearly, the unfunded salary

increases affect escalating

management pensions —

largely driven by overly-

generous top salaries — isn’t

addressed in either pension

reform ballot measure, or

discussed by City officials.

Neither measure reigns in top

management salaries.

Salary reform — the key to

curtailing excessive pensions

for managers — must come

first, before pension reform!

San Francisco employee’s

retirement system is relatively

healthy. It earned a 12.55%

investment return last year —

$1.65 billion — not the 7.75%

annual return Jeff Adachi’s

and Mayor Ed Lee’s flawed

proposals are based on.

But tell that to billionaire

backers Warren Hellman,

George Hume, and Michael

Moritz, who are backing Lee

and Adachi.

These billionaires helped

Lee’s Prop. “C” cap “safety”

pensions at $183,750 and cap

“miscellaneous” pensions at

$208,230. The billionaires

helped Adachi’s Prop. “D” cap

pensions at $140,000. Both

ballot measures failed capping

pensions at $80,000.

Prop. C discriminates against

lower-paid City employees,

requiring a flat 10% pension

contribution for those earning

$50,000 to $100,000.

Prop “D” uses a sliding scale,

but employees earning below

$70,000 may pay up to 13%

while those earning $100,000

to $200,000 pay only15.5%.

Adachi’s sliding scale has five

$10,000 ranges for those earning

$50,000 to $100,000, but only

three $50,000 ranges for those

earning over $100,000. Each

$50,000-step increases only half

a percent, which is patently

unfair to low-wage earners.

Service pensions average

$79,347 for firemen; $70,932

for police officers; and $27,623

for “miscellaneous” employees

(inflated by $100,000+ salaries

of “some miscellaneous” staff).

Employees earning $60,000

with 13 year’s service at age 62

earn small $18,213 pensions.

Highly-paid managers and

safety employees earning over

$100,000 continue collecting

six-figure pensions.

Police and Firefighters’

Special Interests

The police’s DROP program collecting

retirement while earning a second pay

check has already cost San Franciscans

$50 million. That program is now gone.

“Safety” (police, firefighters) employees

recently struck another pension reform

deal until 2015, announced only after

Interim Mayor Lee officially entered

the mayor’s race. Safety employees

contribute 17% of money to the pension

fund, but draw 36% of pension payouts.

Non-safety “miscellaneous” employees

contribute the balance, subsidizing

generous “safety” pensions, an inequity

unaddressed by either Prop’s. “C” or “D.”

A Police Office Association flier in April

2009 indicated their pay raises would go

“from 23% over 4 years to 26%–28% over

5 years.” That’s before they just struck

a new deal with Interim Mayor Ed Lee.

Source: San Francisco Employees'

Retirement System Annual Report Year

Ended June 30, 2010, and Jeff Adachi

While You’re At It … Vote “No” on Propositions “B” Through “G,” Too … Vote “Yes” on Prop. “A,” The School Bonds!

Over

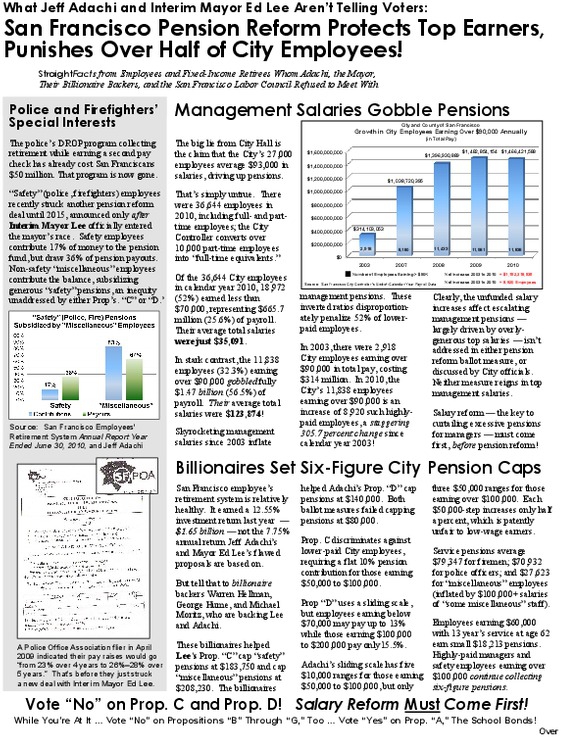

$0

$200,000,000

$400,000,000

$600,000,000

$800,000,000

$1,000,000,000

$1,200,000,000

$1,400,000,000

$1,600,000,000

2003 2007 2008 2009 2010

$314,103,053

$1,038,720,395

$1,396,930,889 $1,482,854,154 $1,466,421,588

City and County of San Francisco

Growth in City Employees Earning Over $90,000 Annually

(in Total Pay)

8,180 11,433 11,981

2,918

Number of Employees Earning > $90K

Source: San Francisco City Controller 's End-of-Calendar-Year Payroll Data

Net Increase 2003 to 2010: + $1,152,318,535

11,838

Net Increase 2003 to 2010: + 8,920 Empoyees

StraightFacts: What Jeff Adachi and Interim Mayor Ed Lee Aren’t Telling Voters

Prop. C Targets Health Service Board Membership

Scapegoating

Public Employees

Public employees didn’t cause the

national economic recession, and

shouldn’t be scapegoated for it,

here or nationally.

But the San Francisco Weekly just

published an article by reporter Joe

Eskenazi on August 31, in which he

claims the defeat of Jeff Adachi’s

pension reform measure “Prop. B”

in November 2010 led to a “direct

result” that Moody’s lowered the

City’s credit rating from Aa1 to

Aa2. Eskenazi blames the credit

rating downgrade only on defeat of

Prop. B, which is patently untrue!

By omission, Eskenazi doesn’t tell

the full story since Moody’s cited

numerous reasons, including in its

report that the credit downgrade:

• “Primarily reflected” the City’s

very narrow financial position.

• Occurred just before the City

sought to peddle $80 million in

new general obligation bonds, on

top of $2.6 billion in outstanding

general obligation.

• Involved “extraordinarily thin”

cash reserves, due in part to the

$1.3 billion in outstanding

principal and interest on another

long-term debt financing scheme

known as “Certificates of

Participation,” which spending

voters have no say over since it

requires just a stroke of the Board

of Supervisors pens to enact.

• Was due in part on the City’s

reliance on one-time solutions,

including draws on reserves to

close structural budget gaps.

• Was due to defeat of revenue

measures in 2010 that might have

helped stabilize the City’s budget

projections, and passage of the

volatile and unpredictable real

estate transfer tax.

Then there’s the $1.47 billion in

skyrocketing salaries noted on the

front of this flier. This represents

$5.4 billion between salaries and

long-term debt that City employees

didn’t create — that neither

Prop. “C” nor Prop. “D” addresses.

The City’s lowest-paid employees

shouldn’t be scapegoated for the

Moody’s credit rating downgrade.

Prop.’s “C” and “D” Punish Those Who Can Least Afford It

Vote “No” on Prop. C and Prop. D! For That Matter, Vote “No” on “B” Through “G”

In November 2004, San

Francisco voters approved a

City Charter change to

transfer the Health Service

Board (HSB) from the City’s

Human Resources Department

to a new City department —

the Health Services System.

Voters authorized changing

HSB’s membership in 2004,

converting the City Attorney

appointee into a fourth seat

elected by current employees

and retirees.

Millions in health benefit

funds “went missing” prior to

2004 when the HSB operated

under the four-member City

“management” majority.

The 2004 measure was put on

the ballot by then Board of

Supervisors Chris Daly, Tom

Ammiano, Fiona Ma, Bevan

Dufty, Jake McGoldrick, Matt

Gonzalez, Michela Alioto-

Pier, Tony Hall, and Gerardo

Sandoval.

The HSB selects medical and

dental plans for current City

employees and retirees, and the

amounts employees and retirees

pay for the health plans.

Supervisor Elsbernd helped

introduce into Mayor Lee’s

“consensus” pension reform

measure two poison pills.

The first poison is a provision

specifying if Prop. “C” gets the

most votes, it will make null

and void the entirety of Public

Defender Jeff Adachi’s pension

measure “D,” including sliding-

scale pension payment increases.

Elsbernd also talked Mayor Lee

into adding Prop. C’s second

poison: A Charter change to

convert the fourth elected HSB

member with a City Controller

appointee. Elsbernd wants the

City to get its hands on (to raid ?)

$65 million in the healthcare trust

fund’s assets, assets that belong to

plan members not to the City.

Help maintain fairness of HSB’s

membership: Vote “No” on “C”!

The San Francisco Labor

Council joined forces with

San Francisco’s Chamber of

Commerce, calling Prop. C a

“spirit of shared sacrifice,” or

alternatively, the “Fairness

Float,” ironically misnamed

since wholly unfair.

While they urge you to Vote

“Yes,” here’s why you should

“Vote No” on “C” and “D”:

The table below shows fully

half (50%) of the City’s

36,644 employees earned a

$65,000 average salary, or

less. Over one-third (37%)

of City employees average

salaries of less than $45,000.

Similarly, while the City’s

pension system data shows

1,218 retirees (6.1%) earned

pensions more than $100,000:

• 41% (8,143 retirees) earned

pensions less than $25,000.

• 32% (6,369 retirees) earned

pensions less than $20,000.

• 22.5% (4,480 retirees) —

nearly one quarter — earned

pensions less than $15,000.

• Another 30% (5,876 retirees)

earn pensions of between

$25,000 and $50,000.

Current employees may face

paying 16% to 20% of their

wages, plus unknown health care

cost increases, if either “C” or

“D” passes. Fixed-income

retirees will also see their health

care costs soar, and will lose the

supplemental COLA.

Those at the lowest end of City

salaries can least afford a 6%

pension contribution increase,

nor can retirees, who may be

forced into dropping dependent

coverage for minor children or

elderly parents, if either Prop.’s

“C” or “D” passes.

The “shared sacrifice” is a myth.

Top wage earners and top retiree’s

share little sacrifice!

Vote “No” on both measures!

Sources: City Controller’s payroll data year ending December 2010, and Retirement System pension amount data September 2011; extract showing 12 of some 40 unions.

Table 1: Average City Salaries and Pensions, by Union Representing Employees

Supervisor Sean Elsbernd snuck health

benefits changes onto Mayor Ed Lee’s

Prop. C “pension” reform ballot measure.

Labor Donated

Union Representing

# Current

Employees Average

Salary # of

Retirees Average

Pension

MEA - Police Department Chiefs 7 $ 271,408 12 $ 165,269

MEA - Fire Department Chiefs 9 $ 261,623 36 $ 148,008

Firefighters 1,464 $ 135,986 1,028 $ 79,347

Police Officers Association 2,359 $ 126,502 1,367 $ 70,932

Municipal Attorney's Association 454 $ 140,481 115 $ 68,306

Teamsters, Local 856 Supervising Nurses 129 $ 144,554 166 $ 60,341

TWU 200, SEAM (Transit Managers and Supervisors) 281 $ 110,929 273 $ 59,327

Municipal Executive Association 1,065 $ 120,417 464 $ 56,430

Local 21, Professional & Technical Engineers 3,976 $ 82,824 1,467 $ 41,849

SEIU Local 1021 Staff & Per Diem Nurses 2,929 $ 70,024 812 $ 39,453

TWU 250-A, 9163 Transit Operators 2,256 $ 65,649 1,352 $ 34,062

SEIU Local 1021, Miscellaneous 13,392 $ 45,710 6,289 $ 24,098

Photo Of Billionaire Warren Hellman-SF Union Officials Following lead of union buster

San Francisco Pension Reform Protects Top Earners,

Punishes Over Half of City Employees!

StraightFacts from Employees and Fixed-Income Retirees Whom Adachi, the Mayor,

Their Billionaire Backers, and the San Francisco Labor Council Refused to Meet With

Management Salaries Gobble Pensions

Billionaires Set Six-Figure City Pension Caps

Vote “No” on Prop. C and Prop. D! Salary Reform Must Come First!

The big lie from City Hall is

the claim that the City’s 27,000

employees average $93,000 in

salaries, driving up pensions.

That’s simply untrue. There

were 36,644 employees in

2010, including full- and part-

time employees; the City

Controller converts over

10,000 part-time employees

into “full-time equivalents.”

Of the 36,644 City employees

in calendar year 2010, 18,972

(52%) earned less than

$70,000, representing $665.7

million (25.6%) of payroll.

Their average total salaries

were just $35,091.

In stark contrast, the 11,838

employees (32.3%) earning

over $90,000 gobbled fully

$1.47 billion (56.5%) of

payroll. Their average total

salaries were $123,874!

Skyrocketing management

salaries since 2003 inflate

management pensions. These

inverted ratios disproportion-

ately penalize 52% of lower-

paid employees.

In 2003, there were 2,918

City employees earning over

$90,000 in total pay, costing

$314 million. In 2010, the

City’s 11,838 employees

earning over $90,000 is an

increase of 8,920 such highly-

paid employees, a staggering

305.7 percent change since

calendar year 2003!

Clearly, the unfunded salary

increases affect escalating

management pensions —

largely driven by overly-

generous top salaries — isn’t

addressed in either pension

reform ballot measure, or

discussed by City officials.

Neither measure reigns in top

management salaries.

Salary reform — the key to

curtailing excessive pensions

for managers — must come

first, before pension reform!

San Francisco employee’s

retirement system is relatively

healthy. It earned a 12.55%

investment return last year —

$1.65 billion — not the 7.75%

annual return Jeff Adachi’s

and Mayor Ed Lee’s flawed

proposals are based on.

But tell that to billionaire

backers Warren Hellman,

George Hume, and Michael

Moritz, who are backing Lee

and Adachi.

These billionaires helped

Lee’s Prop. “C” cap “safety”

pensions at $183,750 and cap

“miscellaneous” pensions at

$208,230. The billionaires

helped Adachi’s Prop. “D” cap

pensions at $140,000. Both

ballot measures failed capping

pensions at $80,000.

Prop. C discriminates against

lower-paid City employees,

requiring a flat 10% pension

contribution for those earning

$50,000 to $100,000.

Prop “D” uses a sliding scale,

but employees earning below

$70,000 may pay up to 13%

while those earning $100,000

to $200,000 pay only15.5%.

Adachi’s sliding scale has five

$10,000 ranges for those earning

$50,000 to $100,000, but only

three $50,000 ranges for those

earning over $100,000. Each

$50,000-step increases only half

a percent, which is patently

unfair to low-wage earners.

Service pensions average

$79,347 for firemen; $70,932

for police officers; and $27,623

for “miscellaneous” employees

(inflated by $100,000+ salaries

of “some miscellaneous” staff).

Employees earning $60,000

with 13 year’s service at age 62

earn small $18,213 pensions.

Highly-paid managers and

safety employees earning over

$100,000 continue collecting

six-figure pensions.

Police and Firefighters’

Special Interests

The police’s DROP program collecting

retirement while earning a second pay

check has already cost San Franciscans

$50 million. That program is now gone.

“Safety” (police, firefighters) employees

recently struck another pension reform

deal until 2015, announced only after

Interim Mayor Lee officially entered

the mayor’s race. Safety employees

contribute 17% of money to the pension

fund, but draw 36% of pension payouts.

Non-safety “miscellaneous” employees

contribute the balance, subsidizing

generous “safety” pensions, an inequity

unaddressed by either Prop’s. “C” or “D.”

A Police Office Association flier in April

2009 indicated their pay raises would go

“from 23% over 4 years to 26%–28% over

5 years.” That’s before they just struck

a new deal with Interim Mayor Ed Lee.

Source: San Francisco Employees'

Retirement System Annual Report Year

Ended June 30, 2010, and Jeff Adachi

While You’re At It … Vote “No” on Propositions “B” Through “G,” Too … Vote “Yes” on Prop. “A,” The School Bonds!

Over

$0

$200,000,000

$400,000,000

$600,000,000

$800,000,000

$1,000,000,000

$1,200,000,000

$1,400,000,000

$1,600,000,000

2003 2007 2008 2009 2010

$314,103,053

$1,038,720,395

$1,396,930,889 $1,482,854,154 $1,466,421,588

City and County of San Francisco

Growth in City Employees Earning Over $90,000 Annually

(in Total Pay)

8,180 11,433 11,981

2,918

Number of Employees Earning > $90K

Source: San Francisco City Controller 's End-of-Calendar-Year Payroll Data

Net Increase 2003 to 2010: + $1,152,318,535

11,838

Net Increase 2003 to 2010: + 8,920 Empoyees

StraightFacts: What Jeff Adachi and Interim Mayor Ed Lee Aren’t Telling Voters

Prop. C Targets Health Service Board Membership

Scapegoating

Public Employees

Public employees didn’t cause the

national economic recession, and

shouldn’t be scapegoated for it,

here or nationally.

But the San Francisco Weekly just

published an article by reporter Joe

Eskenazi on August 31, in which he

claims the defeat of Jeff Adachi’s

pension reform measure “Prop. B”

in November 2010 led to a “direct

result” that Moody’s lowered the

City’s credit rating from Aa1 to

Aa2. Eskenazi blames the credit

rating downgrade only on defeat of

Prop. B, which is patently untrue!

By omission, Eskenazi doesn’t tell

the full story since Moody’s cited

numerous reasons, including in its

report that the credit downgrade:

• “Primarily reflected” the City’s

very narrow financial position.

• Occurred just before the City

sought to peddle $80 million in

new general obligation bonds, on

top of $2.6 billion in outstanding

general obligation.

• Involved “extraordinarily thin”

cash reserves, due in part to the

$1.3 billion in outstanding

principal and interest on another

long-term debt financing scheme

known as “Certificates of

Participation,” which spending

voters have no say over since it

requires just a stroke of the Board

of Supervisors pens to enact.

• Was due in part on the City’s

reliance on one-time solutions,

including draws on reserves to

close structural budget gaps.

• Was due to defeat of revenue

measures in 2010 that might have

helped stabilize the City’s budget

projections, and passage of the

volatile and unpredictable real

estate transfer tax.

Then there’s the $1.47 billion in

skyrocketing salaries noted on the

front of this flier. This represents

$5.4 billion between salaries and

long-term debt that City employees

didn’t create — that neither

Prop. “C” nor Prop. “D” addresses.

The City’s lowest-paid employees

shouldn’t be scapegoated for the

Moody’s credit rating downgrade.

Prop.’s “C” and “D” Punish Those Who Can Least Afford It

Vote “No” on Prop. C and Prop. D! For That Matter, Vote “No” on “B” Through “G”

In November 2004, San

Francisco voters approved a

City Charter change to

transfer the Health Service

Board (HSB) from the City’s

Human Resources Department

to a new City department —

the Health Services System.

Voters authorized changing

HSB’s membership in 2004,

converting the City Attorney

appointee into a fourth seat

elected by current employees

and retirees.

Millions in health benefit

funds “went missing” prior to

2004 when the HSB operated

under the four-member City

“management” majority.

The 2004 measure was put on

the ballot by then Board of

Supervisors Chris Daly, Tom

Ammiano, Fiona Ma, Bevan

Dufty, Jake McGoldrick, Matt

Gonzalez, Michela Alioto-

Pier, Tony Hall, and Gerardo

Sandoval.

The HSB selects medical and

dental plans for current City

employees and retirees, and the

amounts employees and retirees

pay for the health plans.

Supervisor Elsbernd helped

introduce into Mayor Lee’s

“consensus” pension reform

measure two poison pills.

The first poison is a provision

specifying if Prop. “C” gets the

most votes, it will make null

and void the entirety of Public

Defender Jeff Adachi’s pension

measure “D,” including sliding-

scale pension payment increases.

Elsbernd also talked Mayor Lee

into adding Prop. C’s second

poison: A Charter change to

convert the fourth elected HSB

member with a City Controller

appointee. Elsbernd wants the

City to get its hands on (to raid ?)

$65 million in the healthcare trust

fund’s assets, assets that belong to

plan members not to the City.

Help maintain fairness of HSB’s

membership: Vote “No” on “C”!

The San Francisco Labor

Council joined forces with

San Francisco’s Chamber of

Commerce, calling Prop. C a

“spirit of shared sacrifice,” or

alternatively, the “Fairness

Float,” ironically misnamed

since wholly unfair.

While they urge you to Vote

“Yes,” here’s why you should

“Vote No” on “C” and “D”:

The table below shows fully

half (50%) of the City’s

36,644 employees earned a

$65,000 average salary, or

less. Over one-third (37%)

of City employees average

salaries of less than $45,000.

Similarly, while the City’s

pension system data shows

1,218 retirees (6.1%) earned

pensions more than $100,000:

• 41% (8,143 retirees) earned

pensions less than $25,000.

• 32% (6,369 retirees) earned

pensions less than $20,000.

• 22.5% (4,480 retirees) —

nearly one quarter — earned

pensions less than $15,000.

• Another 30% (5,876 retirees)

earn pensions of between

$25,000 and $50,000.

Current employees may face

paying 16% to 20% of their

wages, plus unknown health care

cost increases, if either “C” or

“D” passes. Fixed-income

retirees will also see their health

care costs soar, and will lose the

supplemental COLA.

Those at the lowest end of City

salaries can least afford a 6%

pension contribution increase,

nor can retirees, who may be

forced into dropping dependent

coverage for minor children or

elderly parents, if either Prop.’s

“C” or “D” passes.

The “shared sacrifice” is a myth.

Top wage earners and top retiree’s

share little sacrifice!

Vote “No” on both measures!

Sources: City Controller’s payroll data year ending December 2010, and Retirement System pension amount data September 2011; extract showing 12 of some 40 unions.

Table 1: Average City Salaries and Pensions, by Union Representing Employees

Supervisor Sean Elsbernd snuck health

benefits changes onto Mayor Ed Lee’s

Prop. C “pension” reform ballot measure.

Labor Donated

Union Representing

# Current

Employees Average

Salary # of

Retirees Average

Pension

MEA - Police Department Chiefs 7 $ 271,408 12 $ 165,269

MEA - Fire Department Chiefs 9 $ 261,623 36 $ 148,008

Firefighters 1,464 $ 135,986 1,028 $ 79,347

Police Officers Association 2,359 $ 126,502 1,367 $ 70,932

Municipal Attorney's Association 454 $ 140,481 115 $ 68,306

Teamsters, Local 856 Supervising Nurses 129 $ 144,554 166 $ 60,341

TWU 200, SEAM (Transit Managers and Supervisors) 281 $ 110,929 273 $ 59,327

Municipal Executive Association 1,065 $ 120,417 464 $ 56,430

Local 21, Professional & Technical Engineers 3,976 $ 82,824 1,467 $ 41,849

SEIU Local 1021 Staff & Per Diem Nurses 2,929 $ 70,024 812 $ 39,453

TWU 250-A, 9163 Transit Operators 2,256 $ 65,649 1,352 $ 34,062

SEIU Local 1021, Miscellaneous 13,392 $ 45,710 6,289 $ 24,098

Photo Of Billionaire Warren Hellman-SF Union Officials Following lead of union buster

Add Your Comments

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network