From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

Lessons in Wall Street Leveraging: Who says you can only spend the same dollar once?

Aggressive investing, the latest incarnation of Wall Streets aggressive accounting fraud and financial misrepresentation is a poison pill which has annihilated hundreds of banks, investment banks, hedge funds, pension funds and businesses and shows no signs of slowing down.

The Wall Street Meltdown just keeps growing, but most Americans, including the Press and possibly our national “economic advisors” haven’t a clue about the true breadth and depth of the collapse. Not only are most of us clueless about the impending Depression, we are also clueless about preparation, survival and sustainability for the crisis, during the meltdown, and panic.

First, let’s take the extent of the Meltdown. The true extent of the losses is not being dealt with, even with the “Wall Street Bailout.” Oops. Bailouts.

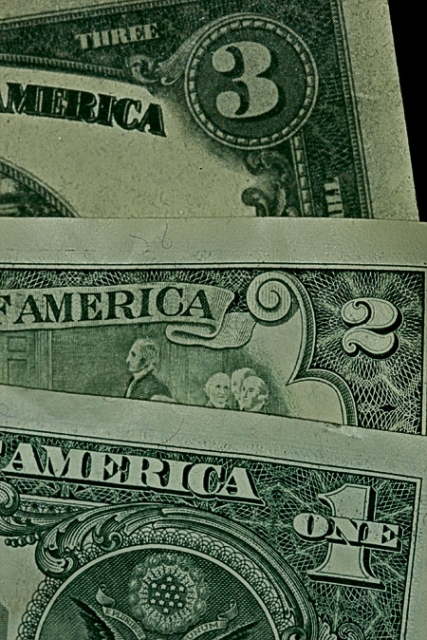

Well, let’s talk a bit about leveraging. That’s Wall Street Math for taking a dollar investment, chopping it up, and “leveraging” it (borrowing on its value) multiple times—for the same dollar.

Leveraging, oh, leveraging. What makes leveraging a bad guy? Take the idea of a “fulcrum” or lever. You know the one—the stick you put over a rock to lift something many times the weight of the stick. The teeter totter you played with as a child. The big stick, little rock and elbow grease that allowed you to “move mountains.”

Using the right lever combination, a 98 pound woman can “lift” or leverage a 300 pound refrigerator, “leveraging” three times her own weight. Unfortunately, in “Quantville” the boys and girls leveraged risky investments, using complex mathematical formulae to slice and dice investments into zillions of fractions. They put the cream on top when they pulled numbers out of their behinds to value these fractional investments, based on unrealistic, unsustainable computer models.

In the process, they violated several rules, namely, you can only spend the same dollar once—once it is out of your hands, it’s gone. You can not chop the dollar up into one hundred pennies and claim each penny has the same value as a whole dollar.

Anywhere else, these conmen/women and fraudsters would be behind bars for fraud, conversion, and who knows what else. But, in that strange universe we call Wall Street, physics, criminal law and common sense apparently don’t exist.

Our intrepid banksters leveraged dollars into trillions of pennies and defied monetary gravity by even more awesome amounts, and now the chickens have come home to roost—and demand their money. But there is no money to be had, especially when the ‘bail out’ is sucked into the black hole that nobody wants to talk about, and the value of the entire derivatives market exceeds the world domestic product.

And, yes, in answer to a critic of an earlier article, not ALL derivatives are radioactive, but, when you are leveraging the same investment multiple times, you multiply the value and reach of that toxic investment across borders, oceans and continents. Which is where we are today.

By now, you are scratching your head and wondering how all of this happened and what it means. How can the government and the central banks, AKA the “Federal Reserve” and the tax payers, bail out a market so leveraged, that some “derivatives” were leveraged at many times their own values, or “weight?”

According to one analyst, some funds were leveraged, at, get this: thirty-five to one!!! That means, they sliced and diced a dollar and invested the SAME DOLLAR thirty-five times!!! Stay with me now, don’t start screaming “That’s impossible.”—Although it is in the “real world,” but these folk live in Wall Street’s environment, not the so-called “real world.”

Just prior to its collapse, Bear Stearns was leveraged 35 to 1. At that insane level, it's pretty obvious how even some small losses could have wiped out everything. (Motley Fool)

They “borrowed” against a single dollar thirty-five times and when the market crashed, they owed $35 dollars for every dollar “invested.” Let’s do the math, then. If an “investor”, “investment bank”, “hedge fund”, or financially irresponsible moron leveraged $100 million in risky investments, when the investment crashed, he would owe 35 x $100 million, which equals $3,500,000,000. All based on getting concurrent loans on the same “dollar” thirty-five times.

Multiply this madness hundreds of millions of times around the world and you can see that this black hole is impossible to fill with the “money” the world has at hand. Leveraged investments equals magnified debt, which equals magnified risk, which equals an unsustainable pyramid scheme, because nobody has the money to pay back investments which are overly leveraged.

Hence, in explaining how the derivatives market can be valued at more than the world economy,

Jacob Leibenluft, writing for Slate magazine, said that is

[b]ecause the same assets might be involved in several different derivatives. A derivative is a financial instrument whose value depends on something else—a share of stock, an interest rate, a foreign currency, or a barrel of oil, for example. One kind of derivative might be a contract that allows you to buy oil at a given price six months from now. But since we don't yet know how the price of oil will change, the value of that contract can be very hard to estimate. (In contrast, it's relatively easy to add together the value of every share being traded on the stock market.) Slate, 10-15-08

What we have today is Enron to the billionth power. Instead of “aggressive accounting” we have “aggressive investing,” where we take the concept of fractional reserve banking, move it to hedge funds and exponentially leverage and magnify debts into still more “investments.”

We then assume the market will expand forever. Based on that assumption, we take one dollar, chop, slice and dice it up into hundreds of parts, invest it all over the world, and when the market crashes, we don’t owe a dollar, we owe hundreds of times the value of a dollar for each dollar we “invested.”

Now, add the idea of fractional reserve banking and deregulated markets to this mess and you have an economic catastrophe that is so monstrous, most politicians don’t understand it, let alone want to talk about it.

Let’s walk back a bit and talk about how fractional reserve banking plays a role in this. In fractional reserve banking, banks keep “reserves” on hand. That means, if a bank has $100,000,000 in deposits, it only keeps a fraction of that on hand, in house. The rest is invested.

According to Wikipedia, “As of 2006 the required reserve ratio in the United States was 10% on transaction deposits.”

In essence, then, banks can take 90 percent of their deposits and invest those deposits, leveraging them far beyond the amount of money they have in deposits. Now, in a worse case scenario, if the banks take 90 percent of their deposits and leverage those deposits, making loans and investments, and then if the people/brokers/institutions they lend the money to take those funds and leverage them into still other loans/investments/monetary madness, you can see the potential for global economic meltdown in a globally, interconnected banking system.

If all the banks are leveraging 90 percent of their deposits as investments and loans, and if those investors or loan recipients are leveraging those same funds 90 percent, that money will soon exceed, (and has) the value of the global money supply. In essence, the system is bankrupted when the market falls and the loans come due.

Just playing around with the numbers, Bank Prime (bank1) has $100,000,000 in assets, statutory reserves of $10,000,000, and is leveraged 90 percent or $90,000,000 into a market that is, itself overly leveraged. Hedge fund1, has $100,000,000 assets, but NO statutory reserve requirement.

So, in the words of a prescient analyst in 2007, “adding derivatives to a mix that includes excessive debt increases the overall risk to the financial system.” (“Financial Times,” January 18, 2007) The banks are overly leveraged; hedge funds are unregulated and overly leveraged and pension plans, state investment funds and retirement funds all stuck their fingers in this toxic mess and continue to lose value.

The stock market is at record lows and continues to fall. All because overly leveraged hedge funds, institutional investors and other investors are getting burned in one of history’s most devastating economic firestorms.

Questioning the value of the toxic derivative market, one critic says the market is not as big or dangerous as some would have it.

Saying there's $668 trillion in derivatives floating out there is like saying every lottery ticket sold is worth the full value of the jackpot. If the jackpot is $100 million and lottery organizers sell 2 million tickets, "that's $200 trillion worth of lottery wealth that's circulating!" jokes Figlewski. "When you say it that way, everybody knows that's a complete nonsense number." (Newsweek, 10-18-08)

Unfortunately, it is not a nonsense number, when we consider the fact that the market has been leveraged multiple times. No, there isn’t $100 million dollars worth of winning lottery tickets out there: The Wall Street banksters and their familiars have sold and resold the same $100 million dollars worth of tickets thousands, tens of thousands of times, all on the pretense that each of them is a winning $100 million ticket.

That is what this entire mess is about: over-leveraging finite investments of undetermined value to generate nearly infinite risks. Sellers have “sold” those $200 trillion dollars worth of lottery tickets multiple times on the assumption that the market would keep rising and they would be able to cover their investments with their winnings.

Leveraging, otherwise known as, the derivatives market, is basically deriving value from monies that are multiplied and it only works when stock and real estate values are rising. In a simple example: if I borrow what a house is worth and invest that money in real estate, hedge funds, or in the stock market in a rising market, I stand to make a pot full of money. However, when the bottom drops out of the market, hedge funds, real estate and other investments drop too and my exposure (debt) is magnified and so are my obligations.

The problem we have is that the toxic, leveraged investments are tainting the whole sector, just like one rotten potato in a sack makes the others rot, if it is not removed. Using the same analogy, we don’t know which

So, not only are we spending money we don’t have, but we are spending it on an exponential basis as part of the Credit Default Swap (CDS), Securitized Investment Vehicles (SIVs), and other toxic incarnations of our highly leveraged markets. And that is where our money has gone: down the tubes because it was overly leveraged with money neither we, nor our hedge funds and high-risk investors have. Without reserves backing those exponentially derived investments, the whole market is a toothless paper tiger.

Those exponentially leveraged investments are market nitroglycerine because:

Hedge funds, lest we forget, have neither minimum capital requirements like a bank nor statutory reserves like a reinsurer, thus the assumption of performance on a CDS obligation held by a hedge fund requires a degree of faith which may be unreasonable. The stability of the entire credit derivatives marketplace rests on the notion that a hedge fund with a CDS obligation will somehow have access to sufficient liquidity to perform, a dubious hope since the spreads on most names quoted in CDS are too tight to support a PD that makes economic sense. (Financial Times, January 18, 2007)

Heretofore, there has been a polite fiction that everybody is telling the truth, that there is no misrepresentation in the market, and all of the “investors” and “borrowers” have the money to repay the loans and cover their losses should the occasion arise. All this in a market, which is exponentially leveraged to unrealistic, unsustainable levels.

Despite clear evidence that the derivatives world is be (sic) driven over the precipice by powerful speculative forces, many risk professionals, managers and regulators pretend that a valid relationship exists between the quoted rate on credit default swap ("CDS") contracts and the underlying credit worthiness of the obligor. (The Institutional Risk Analyst, 1-18-07)

People lie. Investors lie and market professionals pretend the lies and fraud do not exist. Hence, while people stood to make great profits, the elephant in the room was the information and statistics upon which investments were based. These lies, assumptions and over-reliance on computer models have come back to haunt the market, as uncollectible, toxic investments and “leveraged dollars” continue to poison central banks and economies around the world.

In essence, the lies, aggressive accounting/aggressive investing/leveraging/misuse of statistics and criminal suspension of reality have all come home to roost. Aggressive investing, the latest incarnation of Wall Streets aggressive accounting fraud and financial misrepresentation is a poison pill which has annihilated hundreds of banks, investment banks, hedge funds, pension funds and businesses and shows no signs of slowing down.

The market’s appetite for aggressive investing, leveraging, playing with financial dynamite and debt manipulation was AND IS unsustainable. While the market was hot, people made money hand over fist, using “quants”, self-delusion and fiscal alchemy to justify continued investment.

In a nutshell, they had gorged themselves on debt and used that debt to magnify their apparent returns. When they were making money hand over fist, it seemed like a brilliant way to run their businesses. But when the market turned against them, it was deadly. (Ibid)

Like Snow White and the poison apple, markets around the world have crashed after ingesting trillions of dollars worth of tainted investments, whose actual worth was a far cry from stated and assumed values. In essence, the leveraged debt, which unrealistically buoyed the market for years, was actually a time bomb, waiting for the right downturn to send the whole overvalued house of cards crashing down.

The problem with these “fuzzy math” formulas and unreal expectations is, yes, you can “win big” if the market keeps rising. But the market won’t keep rising. What goes up, must come down at some point, and your models are only as good as the statistics upon which they were built. If your assumptions, statistics and raw data are corrupt, so are your results.

And, there’s more trouble on the horizon. As the economy goes south, businesses will be unable to meet their financial obligations. The already over-leveraged CDS market is primed for a major catastrophe if businesses continue to fail and are unable to meet their financial obligations.

A surge in corporate defaults will now leave swap buyers trying to collect hundreds of billions of dollars from their counterparties. This will to complicate the financial crisis, triggering numerous disputes and lawsuits, as buyers battle sellers over the technical definition of default - - this requires proving which bond or loan holders weren't paid -- and the amount of payments due. Some fear that could in turn freeze up the financial system. (“Credit Default Swaps: Next Phase of an Unravelling Crisis” by F. William Engdahl)

And, even with all of the Wall Street Alchemists, AKA Quants, pulling arcane statistical formulas out of their asses and valuing their leveraged assets, these assets have no real value in the real world because they exist only as mathematical constructs in cyberspace. Selling bundled cyber-concocted, over-leveraged products in the real world is coming back to haunt banks, brokers and investors. When the market falls, so does the leveraged market.

Leverage cuts both ways

It's because of excessive leverage among investment banks that a few subprime borrowers failing to pay their mortgages morphed into a global financial catastrophe. (Motley Fool)

While many want to blame this mess on subprime borrowers, it is not the subprime market that caused this mess. People, who misrepresented subprime mortgages as prime investment vehicles, then overly leveraged the value of those shaky mortgages, and packaged the overvalued bundle of toxic risk as secure investments caused catastrophe.

Many of them, their principals, employers, and institutions were well aware of the dangers. They knew many of these leveraged products were based on shady real estate values and uncollectable, leveraged mortgages.

Can we say, fraud? No, but we can say “bailout.”

A note to critics before you start: Yes, much of this piece is worse case scenario.

For more information:

http://www.lulu.com/davis4000_2000

Add Your Comments

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network