From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

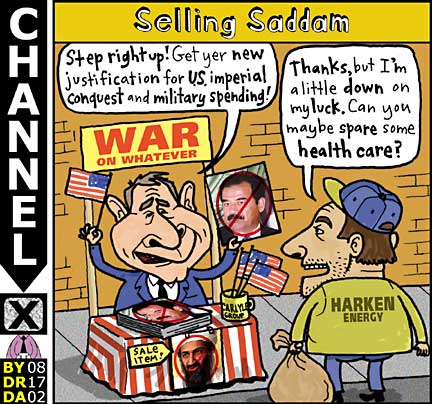

Bush May Have Evaded Taxes On Sale Of Baseball Team

Bush received $18 million on an investment of $616 thousand when the Texas Rangers baseball team was sold to Tom Hicks, a person with whom Bush had prior official business while governor. Tom Hicks was given the opportunity by Bush to use $9 billion of the University of Texas endowment fund without any accountability. The management fee to Hicks for investing the $9 billion could have exceeded the $250 million paid for the Texas Rangers.

BUSH MAY HAVE EVADED TAXES ON SALE OF BASEBALL TEAM

By the Anonymous CPA

Published August 19, 2002

A review of George W. Bush’s 1998 tax return reveals that he reported the sale of his share of the Texas Rangers baseball team as a long term capital gain. As a result, he paid a tax on the more than $15 million proceeds at a tax rate of 20%, as opposed to the 39.6% rate on ordinary income. According to a press release dated June 18, 1998 from the Dallas Morning News, Bush paid $606,000 for about 1.8% of the team and became the managing general partner of B/R Rangers Associates, Ltd., a limited partnership that owned the team. Under the terms of the agreement, Mr. Bush was given an additional 10.2% of the proceeds as additional compensation if the team was sold. The incentive compensation became effective if the other partners received their entire investment back plus a 2% return per year.

The team was purchased for $86 million in 1989 and sold in 1998 for $250 million to Tom Hicks, a person with whom Bush had prior official business while governor. As reported by Tom Kruger in his July 16, 2002 article, Tom Hicks had a relationship with Mr. Bush that afforded Hicks the opportunity to use $9 billion of the University of Texas endowment fund without any accountability. The management fee to Hicks for investing the $9 billion could have exceeded the $250 million he paid for the Texas Rangers. In effect, Bush handed Hicks the money to buy the team as part of his official duties as governor.

In addition, the team received funding for the new stadium built by the City of Arlington. More than $150 million was funded by the City of Arlington with a new sales tax imposed on its citizens. The team leased the stadium from a development corporation that was exempt from any school district tax. The tax exemption directly reduced the lease cost to the team by a substantial amount. In addition, as governor, Mr. Bush supported legislation that would have reduced the team’s school tax by $920,000 if the team exercised its option to purchase the stadium. Furthermore, this proposed tax reduction would have benefited Bush in another entity in which he had an equity interest with some of the partners of the Texas Rangers.

As reported in the Houston Chronicle on April 22, 1997, “The tax reform bill supported by Gov. George W. Bush would have saved at least $2.5 million in school property tax for a company founded by Bush’s billionaire business partner and top campaign contributor, Richard Rainwater of Fort Worth.” Mr. Rainwater headed a public company that was a real estate investment trust traded on the New York Stock Exchange. Bush himself had 4,222 shares of this stock when he proposed the tax reduction that would have benefited this company, Crescent Real Estate Equities, by more than $2.5 million. This same company owned psychiatric hospitals throughout the country that were closed down because of scandalous and fraudulent activities as reported by 60 Minutes and various publications, all before the presidential election of 2000.

As if that was not enough, Bush’s policies as governor further benefited Crescent by:

1. Allowing it to receive an extra $10 million stadium tax for a sports stadium used by the Dallas Mavericks

2. The State of Texas sold three office blocks belonging to the teachers’ retirement fund—to Crescent—the sale of one block costing the pension fund system $44 million.

3. The trust fund for the Texas University Public School invested $20 million in Crescent during Bush’s first term as governor.

Mr. Bush sold his interest in Crescent through his “blind trust,” the Lone Star Trust. Lone Star’s trustee was Mr. Bush’s personal CPA, Robert A. McClesky. Bush’s shares in Crescent were sold at its peak of $40/share, yielding him proceeds of $168,800. Shortly after the sale, Crescent’s stock plunged to $21/share.

Besides the Harken transaction previously reported, Bush has had an excellent record in investing in rapidly appreciating assets. Prior to Harken, he had a rather miserable record of success. However, it is clear that his success was based upon more than normal market appreciation. His political influence before and after he became governor substantially contributed to his personal wealth. The question now rises as to whether this political influence reaches the level of public corruption.

Returning to the sale of the Texas Rangers, it is clear that Mr. Bush earned his additional 10% of the team by adding considerable value to the team because of his political influence. Incentive clauses such as the one granted to Bush are common for managing partners adding value to their partnerships; however, such incentive clauses exercised on behalf of a sitting governor, even if he was not governor when the agreement was written, raises some serious tax questions in addition to the question of public policy conflicts of interest.

According to IRS Revenue Procedure 93-27, “…The receipt of a partnership capital interest for services provided to or for the benefit of the partnership is taxable as compensation.” As most people know, compensation is taxed as ordinary income, subject to the highest tax rates; in this case 39.6%. Mr. Bush treated the incentive portion of his proceeds as long term capital gain, and accordingly reduced his tax liability by at least $2.4 million. Mr. Bush may defend this aggressive tax position by pointing to aggressive planning by his accountants and lawyers. This by itself may be subject to dispute, and even though it is likely that the IRS would treat this incentive payment as ordinary income, Bush could possibly look to his accountants and lawyers as a defense. However, there is a further problem. It involves Otto Kerner, governor of Illinois from 1961 to 1968.

In 1972, Gov. Kerner was convicted of income tax fraud for influencing public policy that benefited his holdings in a race track corporation. On the advice of his accountants, Gov. Kerner treated the proceeds ($180,000) of his race track stock as long term capital gain subject to the reduced tax. The U.S. Attorney, James Thompson, prosecuted Gov. Kerner for falsely treating these proceeds as a capital gain because Gov. Kerner’s public policies had a substantial effect on the appreciation of the stock. Gov. Kerner was a Democrat, and Mr. Thompson was appointed U.S. Attorney by President Nixon. Thompson later became governor of Illinois.

According to an IRS agent who worked on the Kerner case, the government’s theory was based on the idea that a true capital gain is based on the assumption that natural market forces enhance the value of the property sold. Natural market forces can include the legitimate contributions of managing partners. However, the government concluded, and the jury affirmed, the fact that people in official policy positions who enhance the value of their own property in whole or in part are guilty of a corrupt practice, and accordingly the gain is not capital gain. This is consistent with the theory behind giving tax incentives only for legitimate capital appreciation.

It is clear that former Gov. Bush had a clear incentive to affect public policy for his own benefit. In the Kerner case, Gov. Kerner was already a wealthy man, and the proceeds he received were not significant in relation to his net worth. In the case of former Gov. Bush, the at least $12 million incentive he received was the bulk of his liquid assets.

Many of the citizens of Illinois who supported Gov. Kerner were upset about this decision, according to the IRS agent involved. Gov. Kerner was not an active businessman, and many people have doubts that he would have directly affected public policy because of a relatively small holding he had in the race track company. Nevertheless, the jury held him to a higher standard because he was in a powerful public position. According to the IRS agent, if Gov. Kerner was convicted of tax fraud for his behavior relative to a passive holding of stock, Mr. Bush, as an active managing partner of the Texas Rangers, should at least be held to the same standard.

The question is, when will people say enough is enough. All these business and tax practices cannot be based on innocent coincidences.

By the Anonymous CPA

Published August 19, 2002

A review of George W. Bush’s 1998 tax return reveals that he reported the sale of his share of the Texas Rangers baseball team as a long term capital gain. As a result, he paid a tax on the more than $15 million proceeds at a tax rate of 20%, as opposed to the 39.6% rate on ordinary income. According to a press release dated June 18, 1998 from the Dallas Morning News, Bush paid $606,000 for about 1.8% of the team and became the managing general partner of B/R Rangers Associates, Ltd., a limited partnership that owned the team. Under the terms of the agreement, Mr. Bush was given an additional 10.2% of the proceeds as additional compensation if the team was sold. The incentive compensation became effective if the other partners received their entire investment back plus a 2% return per year.

The team was purchased for $86 million in 1989 and sold in 1998 for $250 million to Tom Hicks, a person with whom Bush had prior official business while governor. As reported by Tom Kruger in his July 16, 2002 article, Tom Hicks had a relationship with Mr. Bush that afforded Hicks the opportunity to use $9 billion of the University of Texas endowment fund without any accountability. The management fee to Hicks for investing the $9 billion could have exceeded the $250 million he paid for the Texas Rangers. In effect, Bush handed Hicks the money to buy the team as part of his official duties as governor.

In addition, the team received funding for the new stadium built by the City of Arlington. More than $150 million was funded by the City of Arlington with a new sales tax imposed on its citizens. The team leased the stadium from a development corporation that was exempt from any school district tax. The tax exemption directly reduced the lease cost to the team by a substantial amount. In addition, as governor, Mr. Bush supported legislation that would have reduced the team’s school tax by $920,000 if the team exercised its option to purchase the stadium. Furthermore, this proposed tax reduction would have benefited Bush in another entity in which he had an equity interest with some of the partners of the Texas Rangers.

As reported in the Houston Chronicle on April 22, 1997, “The tax reform bill supported by Gov. George W. Bush would have saved at least $2.5 million in school property tax for a company founded by Bush’s billionaire business partner and top campaign contributor, Richard Rainwater of Fort Worth.” Mr. Rainwater headed a public company that was a real estate investment trust traded on the New York Stock Exchange. Bush himself had 4,222 shares of this stock when he proposed the tax reduction that would have benefited this company, Crescent Real Estate Equities, by more than $2.5 million. This same company owned psychiatric hospitals throughout the country that were closed down because of scandalous and fraudulent activities as reported by 60 Minutes and various publications, all before the presidential election of 2000.

As if that was not enough, Bush’s policies as governor further benefited Crescent by:

1. Allowing it to receive an extra $10 million stadium tax for a sports stadium used by the Dallas Mavericks

2. The State of Texas sold three office blocks belonging to the teachers’ retirement fund—to Crescent—the sale of one block costing the pension fund system $44 million.

3. The trust fund for the Texas University Public School invested $20 million in Crescent during Bush’s first term as governor.

Mr. Bush sold his interest in Crescent through his “blind trust,” the Lone Star Trust. Lone Star’s trustee was Mr. Bush’s personal CPA, Robert A. McClesky. Bush’s shares in Crescent were sold at its peak of $40/share, yielding him proceeds of $168,800. Shortly after the sale, Crescent’s stock plunged to $21/share.

Besides the Harken transaction previously reported, Bush has had an excellent record in investing in rapidly appreciating assets. Prior to Harken, he had a rather miserable record of success. However, it is clear that his success was based upon more than normal market appreciation. His political influence before and after he became governor substantially contributed to his personal wealth. The question now rises as to whether this political influence reaches the level of public corruption.

Returning to the sale of the Texas Rangers, it is clear that Mr. Bush earned his additional 10% of the team by adding considerable value to the team because of his political influence. Incentive clauses such as the one granted to Bush are common for managing partners adding value to their partnerships; however, such incentive clauses exercised on behalf of a sitting governor, even if he was not governor when the agreement was written, raises some serious tax questions in addition to the question of public policy conflicts of interest.

According to IRS Revenue Procedure 93-27, “…The receipt of a partnership capital interest for services provided to or for the benefit of the partnership is taxable as compensation.” As most people know, compensation is taxed as ordinary income, subject to the highest tax rates; in this case 39.6%. Mr. Bush treated the incentive portion of his proceeds as long term capital gain, and accordingly reduced his tax liability by at least $2.4 million. Mr. Bush may defend this aggressive tax position by pointing to aggressive planning by his accountants and lawyers. This by itself may be subject to dispute, and even though it is likely that the IRS would treat this incentive payment as ordinary income, Bush could possibly look to his accountants and lawyers as a defense. However, there is a further problem. It involves Otto Kerner, governor of Illinois from 1961 to 1968.

In 1972, Gov. Kerner was convicted of income tax fraud for influencing public policy that benefited his holdings in a race track corporation. On the advice of his accountants, Gov. Kerner treated the proceeds ($180,000) of his race track stock as long term capital gain subject to the reduced tax. The U.S. Attorney, James Thompson, prosecuted Gov. Kerner for falsely treating these proceeds as a capital gain because Gov. Kerner’s public policies had a substantial effect on the appreciation of the stock. Gov. Kerner was a Democrat, and Mr. Thompson was appointed U.S. Attorney by President Nixon. Thompson later became governor of Illinois.

According to an IRS agent who worked on the Kerner case, the government’s theory was based on the idea that a true capital gain is based on the assumption that natural market forces enhance the value of the property sold. Natural market forces can include the legitimate contributions of managing partners. However, the government concluded, and the jury affirmed, the fact that people in official policy positions who enhance the value of their own property in whole or in part are guilty of a corrupt practice, and accordingly the gain is not capital gain. This is consistent with the theory behind giving tax incentives only for legitimate capital appreciation.

It is clear that former Gov. Bush had a clear incentive to affect public policy for his own benefit. In the Kerner case, Gov. Kerner was already a wealthy man, and the proceeds he received were not significant in relation to his net worth. In the case of former Gov. Bush, the at least $12 million incentive he received was the bulk of his liquid assets.

Many of the citizens of Illinois who supported Gov. Kerner were upset about this decision, according to the IRS agent involved. Gov. Kerner was not an active businessman, and many people have doubts that he would have directly affected public policy because of a relatively small holding he had in the race track company. Nevertheless, the jury held him to a higher standard because he was in a powerful public position. According to the IRS agent, if Gov. Kerner was convicted of tax fraud for his behavior relative to a passive holding of stock, Mr. Bush, as an active managing partner of the Texas Rangers, should at least be held to the same standard.

The question is, when will people say enough is enough. All these business and tax practices cannot be based on innocent coincidences.

Add Your Comments

Latest Comments

Listed below are the latest comments about this post.

These comments are submitted anonymously by website visitors.

TITLE

AUTHOR

DATE

Tea Party Tanny

Thu, Aug 22, 2002 4:31PM

Indite Bush For Tax Evasion

Wed, Aug 21, 2002 7:43PM

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network