From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

Puerto Rico: Labor and The Fight Against Neoliberalism and Colonialism Presentation

Javier Córdova spoke in San Francisco about the labor struggles in Puerto Rico and the attack on education and public services.

Puerto Rico: Labor and The Fight Against Neoliberalism and Colonialism Presentation

https://www.youtube.com/watch?v=kRH6fNPd_w8

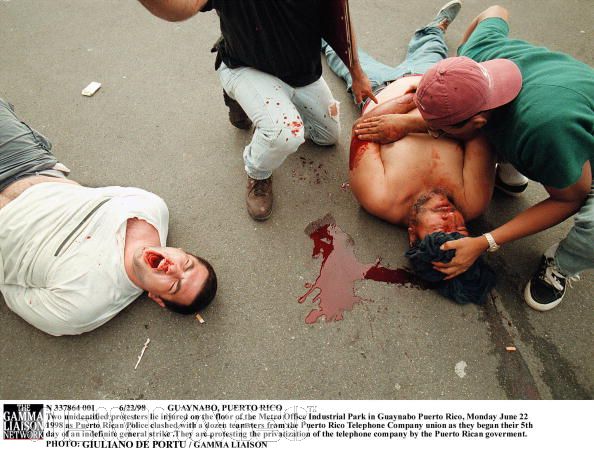

Javier Córdova is the President of the Puerto Rican Association of University Professors (A.P.P.U.) at the University of PR-Arecibo campus and also serves on A.P.P.U.’s national board and its Executive Committee. He is also leader of the Working Peoples’ Party. He spoke in San Francisco on July 25, 2015 on the economic crisis in Puerto Rico and the role of the US in pushing privatization and union busting. He was introduced by Ricardo Ortiz.

Production of Labor Video Project

http://www.laborvideo.org

Hedge funds tell Puerto Rico: lay off teachers and close schools to pay us back

http://www.theguardian.com/world/2015/jul/28/hedge-funds-puerto-rico-close-schools-fire-teachers-pay-us-back

Report commissioned by 34 hedge funds says government had been ‘massively overspending on education’ despite spending only 79% of US average per pupil

Billionaire hedge fund managers have called on Puerto Rico to lay off teachers and close schools so that the island can pay them back the billions it owes.

The hedge funds called for Puerto Rico to avoid financial default – and repay its debts – by collecting more taxes, selling $4bn worth of public buildings and drastically cutting public spending, particularly on education.

The group of 34 hedge funds hired former International Monetary Fund (IMF) economists to come up with a solution to Puerto Rico’s debt crisis after the island’s governor declared its $72bn debt “unpayable” – paving the way for bankruptcy.

The funds are “distressed debt” specialists, also known as vulture funds, and several have also sought to make money out of crises in Greece and Argentina, the collapse of Lehman Brothers and the near collapse of Co-op Bank in the UK.

The report, entitled For Puerto Rico, There is a Better Way, said Puerto Rico could save itself from default if it improves tax collection and drastically cuts back on public spending.

It accused the island, where 56% of children live in poverty, of spending too much on education even though the government has already closed down almost 100 schools so far this year.

Graph about the economy of Puerto Rico and education expenditures – taken from a report prepared by Centennial Group International. Photograph: Centennial Group International

The report, by Jose Fajgenbaum, Jorge Guzmán and Claudio Loser – all former IMF economists who now work for Centennial Group, said Puerto Rico had increased education spending by $1.4bn over the past decade while enrolment had declined by about 25% as hundreds of thousands of families fled to the US mainland in an effort to escape poverty.

Puerto Rico debt crisis: austerity for residents, but tax breaks for hedge funds

Puerto Rico has actively courted billionaires and hedge fund investors as it has struggled with its mounting debts. It sold hundreds of millions worth of debt to vulture funds last year.

Fajgenbaum told the Guardian that the Puerto Rico government had been “massively overspending on education”. He said spending had increased by 39% to $4.8bn over the last decade while attendance had fallen from more than 765,000 to 573,000.

He declined to state by how much the government should cut spending, but said: “The real expense per student has increased enormously without increasing the quality of education. It’s for the government to decide [how much to cut spending by], but you don’t want to waste government resources. There has to be efficiencies. It is more important to establish a position for growth.”

Puerto Rico’s current education spending works out at $8,400 per student, below the US national average of $10,667.

Víctor Suárez, chief of staff to Puerto Rico’s governor Alejandro García Padilla, said: “The simple fact remains that extreme austerity [alone] is not a viable solution for an economy already on its knees.”

Luis Gallardo, majority municipal legislator for Aguas Buenas, said the hedge fund-commissioned report was a “typically IMF recipe for radical austerity”.

“They are proposing teacher layoffs, cuts in higher education and health benefits, as well as increased taxes. These proposals have been a disaster for Latin America and would be so for Puerto Rico. Sure, Puerto Rico could pay its debt, but at what cost? We are literally cutting off our own limbs just to stay afloat.

Puerto Rico's 'unpayable' debt: is this the Greece of the western hemisphere?

“The Puerto Rican government has already closed down almost 100 schools this year and reconfigured 500 more, as well has having closed down 60 the year prior. I am not sure what else they are expecting. If they expect us to lay off teachers or cut their already-low salaries, they are out of their minds.

“These guys need to chill out and give Puerto Rico some breathing space.”

Gallardo said it was shocking that the hedge funds “expect teachers, students and workers to absorb the hit, and they are not willing to budge themselves”.

The hedge fund-commissioned report comes after former IMF official Anne Krueger said, in a report commissioned by the Puerto Rican government, that the island’s crisis could be solved but only if the bondholders, including the hedge funds, accepted a significant debt restructuring.

The funds, which include New York-based Fir Tree Partners, Davidson Kempner Capital Management and Aurelius Capital, are known as the Ad Hoc Group of Puerto Rico and hold $5.2bn of Puerto Rico bonds.

Politicians think Puerto Ricans are dumb. But we know the debt crisis is their doing

Julio Ricardo Varela

Fir Tree Partners, which is named after its multibillionaire founder Jeff Tannenbaum (which means fir tree in German), made a lot of money by betting on complex debt securities in the 2008 financial crisis, and from the Greek and Argentinian debt crises.

Aurelius Capital, which is run by billionaire Mark Brodsky, sued Argentina for repayment of debts and forced the Co-op to give up control of its troubled bank. The company was also one of the investors that initially objected to Detroit’s bankruptcy plans.

Fajgenbaum and Loser said the hedge funds did not influence the content of their report, and declined to state how much money they were paid for their work.

https://www.youtube.com/watch?v=kRH6fNPd_w8

Javier Córdova is the President of the Puerto Rican Association of University Professors (A.P.P.U.) at the University of PR-Arecibo campus and also serves on A.P.P.U.’s national board and its Executive Committee. He is also leader of the Working Peoples’ Party. He spoke in San Francisco on July 25, 2015 on the economic crisis in Puerto Rico and the role of the US in pushing privatization and union busting. He was introduced by Ricardo Ortiz.

Production of Labor Video Project

http://www.laborvideo.org

Hedge funds tell Puerto Rico: lay off teachers and close schools to pay us back

http://www.theguardian.com/world/2015/jul/28/hedge-funds-puerto-rico-close-schools-fire-teachers-pay-us-back

Report commissioned by 34 hedge funds says government had been ‘massively overspending on education’ despite spending only 79% of US average per pupil

Billionaire hedge fund managers have called on Puerto Rico to lay off teachers and close schools so that the island can pay them back the billions it owes.

The hedge funds called for Puerto Rico to avoid financial default – and repay its debts – by collecting more taxes, selling $4bn worth of public buildings and drastically cutting public spending, particularly on education.

The group of 34 hedge funds hired former International Monetary Fund (IMF) economists to come up with a solution to Puerto Rico’s debt crisis after the island’s governor declared its $72bn debt “unpayable” – paving the way for bankruptcy.

The funds are “distressed debt” specialists, also known as vulture funds, and several have also sought to make money out of crises in Greece and Argentina, the collapse of Lehman Brothers and the near collapse of Co-op Bank in the UK.

The report, entitled For Puerto Rico, There is a Better Way, said Puerto Rico could save itself from default if it improves tax collection and drastically cuts back on public spending.

It accused the island, where 56% of children live in poverty, of spending too much on education even though the government has already closed down almost 100 schools so far this year.

Graph about the economy of Puerto Rico and education expenditures – taken from a report prepared by Centennial Group International. Photograph: Centennial Group International

The report, by Jose Fajgenbaum, Jorge Guzmán and Claudio Loser – all former IMF economists who now work for Centennial Group, said Puerto Rico had increased education spending by $1.4bn over the past decade while enrolment had declined by about 25% as hundreds of thousands of families fled to the US mainland in an effort to escape poverty.

Puerto Rico debt crisis: austerity for residents, but tax breaks for hedge funds

Puerto Rico has actively courted billionaires and hedge fund investors as it has struggled with its mounting debts. It sold hundreds of millions worth of debt to vulture funds last year.

Fajgenbaum told the Guardian that the Puerto Rico government had been “massively overspending on education”. He said spending had increased by 39% to $4.8bn over the last decade while attendance had fallen from more than 765,000 to 573,000.

He declined to state by how much the government should cut spending, but said: “The real expense per student has increased enormously without increasing the quality of education. It’s for the government to decide [how much to cut spending by], but you don’t want to waste government resources. There has to be efficiencies. It is more important to establish a position for growth.”

Puerto Rico’s current education spending works out at $8,400 per student, below the US national average of $10,667.

Víctor Suárez, chief of staff to Puerto Rico’s governor Alejandro García Padilla, said: “The simple fact remains that extreme austerity [alone] is not a viable solution for an economy already on its knees.”

Luis Gallardo, majority municipal legislator for Aguas Buenas, said the hedge fund-commissioned report was a “typically IMF recipe for radical austerity”.

“They are proposing teacher layoffs, cuts in higher education and health benefits, as well as increased taxes. These proposals have been a disaster for Latin America and would be so for Puerto Rico. Sure, Puerto Rico could pay its debt, but at what cost? We are literally cutting off our own limbs just to stay afloat.

Puerto Rico's 'unpayable' debt: is this the Greece of the western hemisphere?

“The Puerto Rican government has already closed down almost 100 schools this year and reconfigured 500 more, as well has having closed down 60 the year prior. I am not sure what else they are expecting. If they expect us to lay off teachers or cut their already-low salaries, they are out of their minds.

“These guys need to chill out and give Puerto Rico some breathing space.”

Gallardo said it was shocking that the hedge funds “expect teachers, students and workers to absorb the hit, and they are not willing to budge themselves”.

The hedge fund-commissioned report comes after former IMF official Anne Krueger said, in a report commissioned by the Puerto Rican government, that the island’s crisis could be solved but only if the bondholders, including the hedge funds, accepted a significant debt restructuring.

The funds, which include New York-based Fir Tree Partners, Davidson Kempner Capital Management and Aurelius Capital, are known as the Ad Hoc Group of Puerto Rico and hold $5.2bn of Puerto Rico bonds.

Politicians think Puerto Ricans are dumb. But we know the debt crisis is their doing

Julio Ricardo Varela

Fir Tree Partners, which is named after its multibillionaire founder Jeff Tannenbaum (which means fir tree in German), made a lot of money by betting on complex debt securities in the 2008 financial crisis, and from the Greek and Argentinian debt crises.

Aurelius Capital, which is run by billionaire Mark Brodsky, sued Argentina for repayment of debts and forced the Co-op to give up control of its troubled bank. The company was also one of the investors that initially objected to Detroit’s bankruptcy plans.

Fajgenbaum and Loser said the hedge funds did not influence the content of their report, and declined to state how much money they were paid for their work.

Add Your Comments

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network